Markets

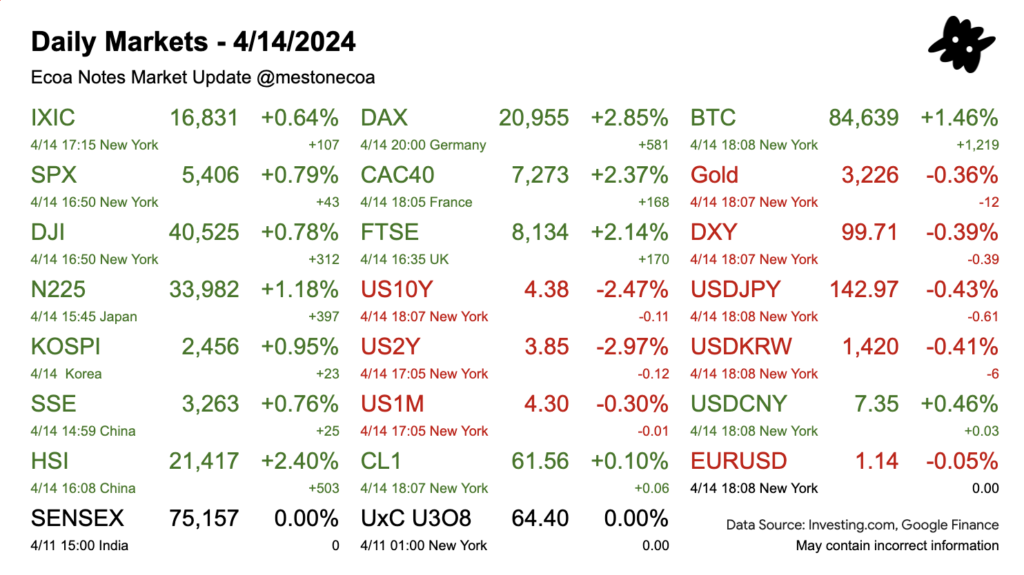

Although Trump says smartphone tariffs are here to stay, flexibility in policy retains optimism in the market. Initially staring out higher, US indices fell, although closing in the green. Global equities exhibited a similar level of optimism. Some recovery in the bond market brought yields down. $US10Y fell to 4.38% after soaring to 4.50%. $BTC reclaimed $85k, after touching $75k. What has not shown signs of recovery is $DXY. In early January the index recorded 109. Now it’s more than 10% down, at 99.71.

Headlines and Quotations

WSJ

Netflix Aims to Join the $1 Trillion Club

- “Netflix aims to achieve a $1 trillion market capitalization and double its revenue by 2030, ambitious goals that show its growing heft as the largest global streamer.”

Civilian Death Toll in Ukraine Climbs as Putin Resists Trump’s Peace Drive

- “Ukraine and European countries said the latest Russian missile strike, which killed 34 and left more than 100 injured in the city of Sumy on Sunday, showed Russian President Vladimir Putin wasn’t interested in a cease-fire.”

Wall Street’s Trading Revenue Powered by Tariff Uncertainty

- “Banks have been raking in fees as investors reposition their portfolios in anticipation of how Trump’s trade and other economic policies might rattle markets.”

Stocks Post Gains; Dow Rises More Than 300 Points

- “The president also said Monday afternoon that he is looking at some tariff pauses to help car companies. Shares of automakers like Ford and General Motors perked up on the news.”

CNBC

Sony raises PlayStation 5 prices in Europe citing ‘challenging’ economic environment

- The company said the U.K. recommended retail price is £429.99, a rise from the previous price of £389.99.

Unemployment fears hit worst levels since Covid as tariffs fuel inflation outlook, Fed survey shows

- “Consumer worries grew over inflation, unemployment and the stock market as the global trade war heated up in March, according to a Federal Reserve Bank of New York survey released Monday.”

Auto stocks rise as Trump says he wants to ‘help’ some car companies

- “I’m looking for something to help some of the car companies, where they’re switching to parts that were made in Canada, Mexico and other places, and they need a little bit of time because they’re going to make them here,”

Reuters

US stocks, Treasuries rebound but dollar dips amid tariff uncertainty

- “U.S. shares gained on Monday, while the dollar dipped, after the White House exempted smartphones and computers from U.S. tariffs but President Donald Trump said semiconductor levies were likely.”

Meta to use public posts, AI interactions to train models in EU

- “Meta Platforms said on Monday it would use interactions that users have with its AI, as well as public posts and comments shared by adults across its platforms, to train its artificial intelligence models in the European Union.”

US begins probes into pharmaceutical, chip imports, setting stage for tariffs

Investing.com

Newell Brands sees Moody’s rating downgrade with negative outlook

- “Despite Newell’s larger manufacturing footprint in the US compared to some of its competitors, which provides it with a competitive advantage, and declines in the cost of some inputs, such as oil, gas, and plastic, the company’s ability to implement pricing actions to improve margins will be limited. This is due to the discretionary nature of most of its products and weaker consumer demand.”

- “Newell is also expected to face higher borrowing costs as it seeks to refinance its significant upcoming debt maturities.”