Markets

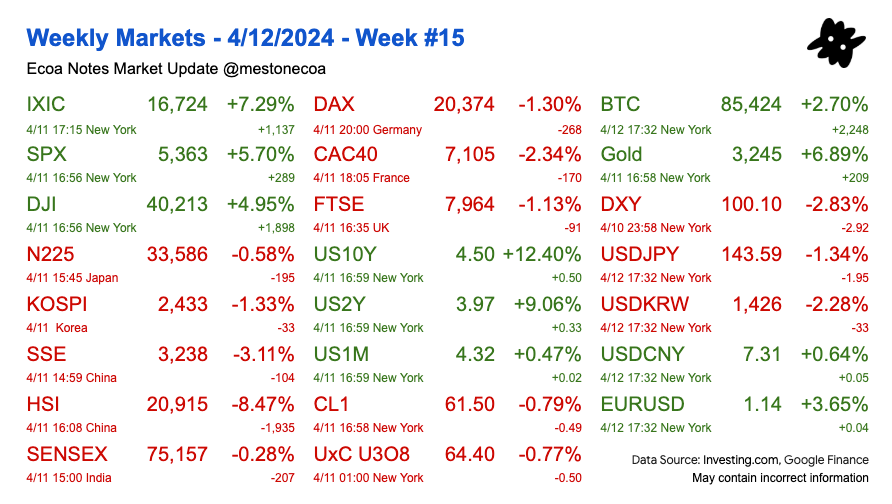

Significant swings were observed in the market. Since Liberation Day, $SPX recorded daily changes of -4.8%, -6.0%, -0.2%, -1.6%, +9.5%, -3.5%, and +1.8%. On a weekly basis, $SPX fell -9.1% last week and rose +7.3% this week, resulting in a -8.6% YTD decline. Treasury yields saw major swings as well. #US10Y ended at 400bps last week. Following a frenzy of long-dated bond sell-offs this week, however, yields closed at 450bps, recording a 12.4% rise. The increased refinancing cost of government debt is considered a key factor behind the 90-day reprieve on Liberation Day levies. $BTC rose above 80k again on the news. $Gold also resumed its ascent, reaching $3,245 per ounce. The dollar continued its decline, with $DXY closing barely above 100 after falling -2.8% for the week. #Oil, after dipping below $60/barrel, barely retained the $60 mark by the end of the week. Hong Kong stocks suffered significantly, with $HSI -8.5% and $SSE -3.1% as the US-China trade battle intensified.

Headlines and Quotations

Bloomberg

Apple, Nvidia Score Relief From US Tariffs With Exemptions

- “Trump’s administration exempted smartphones, computers and other electronics from its so-called reciprocal tariffs.”

Bessent Has a ‘Grand Encirclement’ Plan for China

- “The nations Bessent said he’s looking to – Japan, South Korea, Vietnam and India – happen to be neighbors of China.

- “The Obama administration’s big trade idea was using the Trans-Pacific Partnership to assemble a coalition of Pacific Rim nations that would increasingly be tied to the US and not drift into China’s orbit. Trump abandoned the TPP shortly after first taking office in January 2017.”

Oaktree, TCW and Sona Spot Opportunity in Market Turmoil

- “Average spreads in the US HY bond market are about 419bps – lingering around the highest since late 2023”

- “The market is running from credits with tariff-related risk,” he said. “There are going to be survivors in that cohort and we want to identify those and invest in them at improved prices.”

UK MPs Pass Emergency Bill to Rescue Troubled British Steel

By Plan or Luck, Trump Landed His First Blow on China

- US needs to limit China’s access to Western markets and deepen integration with advanced democracies.

CNBC

Trump tariffs on China will soon bring ‘irreversible’ damage to many American businesses

- “For most businesses in the U.S., orders from China are being canceled and Chinese freight being shipped could be abandoned.”

- “We had the same across Southeast Asia, but after the 90-day reprieve those bookings have restarted,”

As U.S. and Iran look to begin nuclear talks amid fresh sanctions, can there be a deal?

How China used Vietnam to evade higher U.S. tariffs

- “A portion of Vietnam’s rising exports to the U.S. may be Chinese products that were rerouted to evade higher tariff rates.”

- “Think 24-hour markets and a trading settlement process that can be compacted down into seconds from a process that today can still take days, with billions of dollars reinvested immediately back into the economy.”

Trump’s ongoing 25% auto tariffs expected to cut sales by millions, cost $100 billion

Investing.com

UK finance minister eyes closer EU ties, warns ’profound’ impact of tariffs

- “she wants to achieve “an ambitious new relationship” with the European Union while still negotiating a trade deal with the United States.”

07:56-08:38