The objective of this exercise is to research a company to a reasonable depth using a reasonable amount of time, with the belief that a) whatever level of research conducted, there will still remain an area of unknown b) the most efficient way to get better at analyzing is with a manageable single cycle, that gets iteratively better c) getting my hands dirty by covering a breadth of companies will yield a new sense of understanding or at least provide the subsequent sense of direction.

1. How the Business Makes Money

Chipotle Mexican Grill, Inc. makes money buy selling Mexican menu such as burrito, burrito bowls, quesadillas, tacos, and salads across their 3,531 stores. Like other restaurant chains, they have Limited Time Offer menus, such as brisket and chicken al Pastor, adding diversity to their line-up. Their most popular menu is their burrito bowl. In the video shows how simple and quick it is to make, and how healthy it is. My assessment of their fundamental strength is in the peculiarity of their cuisine. It has the friendliness, casualness comparable to a fast food chain, while also capturing the healthiness aspect. A delicious quick bite of protein, vegetables and some carbs has great appeal to the average value-seeking diner. The menu is easy to make. The bulk of preparation can happen pre-peak hours. Dedicating the busy hours to the assembly and simple heat-ups. This would require only modest training, and provide greater throughput. It also has greater room for automation, since preparing the ingredients can be done in bulk. With their popularity proven, it is a good business. In other markets where Mexican cuisine has a lesser proven record, this may not be true. Given their price range, “an affordable, healthy, quick, everyday meal” could be hard to sell.

In 2023, the company recorded $9.9b in revenue, gross profit of $2.6b (26%), operating profit of $1.6b (16%) and net profit of $1.2b (12%). The three profit margins metrics compared to Starbucks is nearly identical. Given that half of Starbucks stores are licensed, which yields higher margin per dollar revenue, this figure is quite amazing. It’s a simple business where their food and beverage segment accounts for 99% of their segment. As of 2Q 2024 they run 3,530 company-operated stores, 3,460 (98%) of which are located in the US. They have 1 licensed store in Kuwait. With positive review, Chipotle has plans to open a second licensed store in Dubai. Food, beverage and packaging is 29% of revenue, labor 25%, and occupancy 5%.

Chipotle’s values have a big emphasis on good ingredients. Here are some catch phrases.

• We believe that food has the power to change the world.

• Being real means making food fresh every day. No artificial flavors, colors or preservatives. No freezers, can openers, or shortcuts.

• Being real means we only use 53 ingredients that you can pronounce. (And the only ingredient that is hard to pronounce at Chipotle is “Chipotle.”)

• Being real means fighting for our planet.

• Being real means treating our people right.

• Real ingredients. Real purpose. Real flavor.

2. Key elements of recent earnings call & IR materials

From Q3 FY24 earnings call transcript

Confidence is evident the CEO’s voice as Brian Niccol (who moved on to be the CEO of Starbucks in September) begins by saying “The second quarter was outstanding.” The company has beat estimates for several consecutive quarters. 2Q24 saw an 18% growth in sales to $3b. Comp grew 11%, driven by 8% transaction comp owing to greater throughput. Chipotle restaurants also have remarkable restaurant level margin, that is still growing. It was 28.9%, from an already high 27.5%. Restaurant level margins can get as low to around 5% for fine dining, and 10-20% for fast food or casual dining. Aside for the typical employee training, talent retention, digitalization, marketing and LTO initiatives that are commonplace strategies in this industry, there were two that caught my eye.

First is technology innovation including dual side grilling and Autocado machine. Autocado reduces the time to make a batch of guacamole (my guess is 30 to 50 avocados) from 50min to 25min. Autocado is about to be pilot tested in the first restaurant. Dual side grilling that is being tested in 10 restaurants yielded positive feedback, halving the cooking time and better retaining moisture. They will to introduce dual-side grilling to 74 high-volume restaurants this year.

Second is the continuation of their growth strategy. This is commonplace for other chains as well, but Chipotle is particularly big upside potential. There are over 15k McDonald’s and Starbucks locations in the US. Chipotle is currently sitting at 3500 and is targeting 7,000 locations for now. Adding 52 locations in 2Q, they are on track with meeting this year’s target. The company addressed the issue on social media that Chipotle portions are not what they used to be, by reemphasizing that generous portions is a core brand identity and overseeing the stores to make sure that portions are according to guidelines.

Source: Chipotle

3. Key Financials and Ratios

Earnings

The average Chipotle restaurant made $3m in 2023. Store expansion is only around 6-8% per year. This is quite slow for a hit fast casual restaurant

that has 3,500 stores. Starbucks store growth was well over 20% per year before they hit 10k stores. They added 97 stores in the first half of 2024.

That is a 3% growth from 2023. While it seems that could have done better, consumer confidence is low in 2024, enabling Costco and Walmart to gain

more appeal.

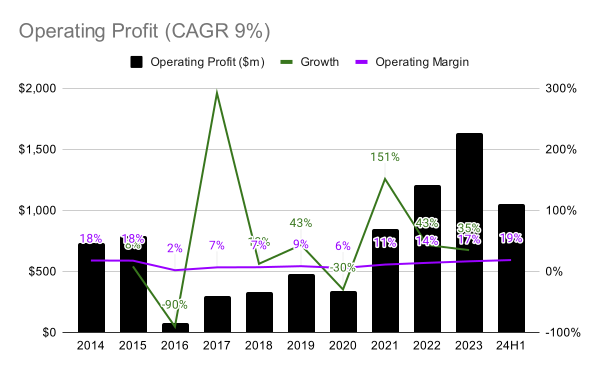

There were incremental advancement in margins. In 24H1, gross margin was 28% (+4%p in 2 years), operating margin was 19% (+5%p in 2 years),

and net profit margin was 14% (+4%p in 2 years). The gross margin of 28% is in line with restaurant level margin provided in the earnings call.

Earnings have been growing at around 10% on average in the last 10 years. The exception is in 2016. A 13% drop in sales resulted in a 58% drop in

gross profit, a 90% drop in operating profit and 95% drop in net profit. Margins were stretched very thin. The company was responsible for a foodbourn

illness, the E. coli virus. This forced them to close some 43 restaurants and pay a $25m federal fine for the poisoning of 1,000+ people. It cost Chipotle dearly to regain consumer trust. An article says, that the company did well in moving away from promo-type marketing campaigns to promoting

healthy ingredients. Before, Chipotle’s marketing strategy was to flood the market with “promo and BOGO-type offers” which, according to CMO Chris Brandt “did not drive traffic. Chipotle had not been driving traffic for the last two years.” The company decided to double down on its unique value proposition: fresh ingredients and restaurant-style food prep techniques that defied categorization as a QSR or a fast food chain, putting Chipotle in what Brandt calls “a category of one.

Source: CNN

Dividends & Stock Repurchase

Chipotle does not pay dividends. Instead, the company has a history of repurchasing shares, most notably during the food poisoning crisis of 2016. They also repurchased shares in 2022 when share price was falling. The minimal licensing business model makes the balance sheet asset heavy. It is also more susceptible when growth dwindles, especially from company specific issues as like food quality and brand perception.

Liquidity and Solvency Ratios

The company’s liquidity and solvency ratios are quite good. With Debt-to-equity at 1.15, current ratio at 1.71, quick ratio at 1.68. More cautious food chains that are in the expansionary phase have current ratio closer to 2.

Source: Gurufocus

Cash Flow

Chipotle’s 2023 operating cashflow was $1.8b, investing cashflow -$950m, financing cash flow -$660m. Free Cash Flow has been positive in the past 10 years. In 2023, it was $1.2b.

4. If I had to predict the prospects of the business

I see great upside for Chipotle. The total number of stores is low compared to established brands. They haven’t even penetrated ex-US markets aggressively yet. They also haven’t explored the licensing business. Once that happens it will be a catalyst for explosive, asset-light growth. Subway has 20k stores in the US and more than 30k stores worldwide. It is true that sandwiches have more widespread appeal than Mexican cuisine, I see the propositions largely similar. Their most popular burrito bowl, I feel, is more like a salad with good protein, with a Mexican touch. It has potential to cater the everyday meals of non-US people.

The type of food they serve has great appeal. Consumers deem their product to have good quality. Decreasing portions were an issue on social media, but it seems to have faded away, and the company acted promptly to address those complaints. It has done well when rates were high and consumer confidence is low. Since we are headed for a cooling phase and an easing of monetary policy, it would be favorable for a business that serve cost effective meals. Although not cheap compared to fast food chains, their menu could still lure people with modest buying power who seek healthy, decently-portioned meals.

Also, their menu is fit for automation. Technology could be used to prepare ingredients more quickly. They are already making strides with Auto-Cado and dual side grills. Heightened efficiency will be critical when they finally choose to tap into foreign markets. It is impressive that their profit margins have constantly grown and yet more upside remains. Some things to keep track of on an ongoing basis,

– Social media mentions

– Google trends

– Chipotle YouTube channel and newsroom

– Quarterly earnings call

– Store count and growth rate

– Menu price

If I had more time to investigate I would

1. Dive deeper into lease accounting.

2. Dive deeper into different costs and see how much further margins can be cut

3. Research Mexican cuisine reception is other countries

4. Compare metrics with other restaurant companies

Written from scratch by Meston Ecoa

May contain incorrect data and information