The objective of this exercise is to research a company to a reasonable depth using a reasonable amount of time, with the belief that a) whatever level of research conducted, there will still remain an area of unknown b) the most efficient way to get better at analyzing is with a manageable single cycle, that gets iteratively better c) getting my hands dirty by covering a breadth of companies will yield a new sense of understanding or at least provide the subsequent sense of direction.

1. How the Business Makes Money

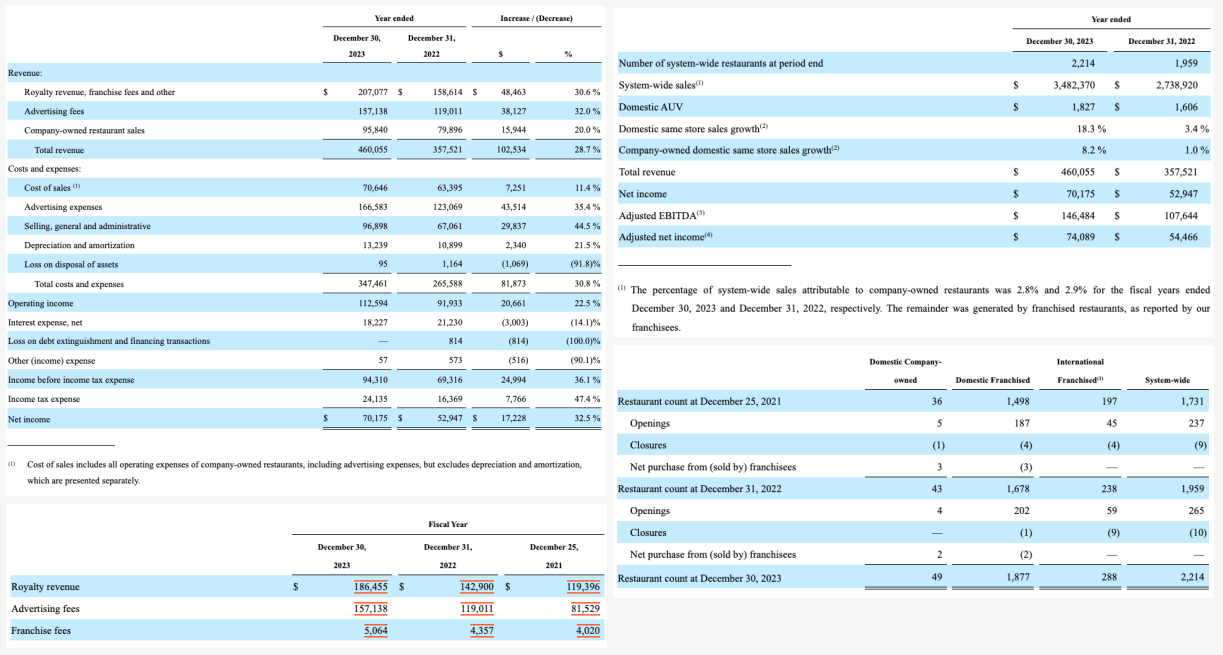

Wingstop makes money by selling chicken – buffalo wing, chicken tender and most recently, chicken sandwich, primarily through their fleet of franchise stores. It started as a buffalo chicken wing restaurant in Texas in 1994. The company went public in 2015. From a revenue of $78m in 2015, it grew to $460m in 2023. In 2015 there were a total of 845 stores. Only 19 of which were company owned. 786 locations were in the US. Internationally, Mexico had the most stores with 34 locations, followed by 10 stores in Indonesia. In 2023, they had 2,214 stores, 2,165 of which were franchised. There were 288 locations overseas, all of which were franchised.

10-K 2023

“Wingstop is the largest fast casual chicken wings-focused restaurant chain in the world and has demonstrated strong, consistent growth. As of December 30, 2023, we had a total of 2,214 restaurants in our system. Our restaurant base is 98% franchised, with 2,165 franchised locations (including 288 international locations) and 49 company-owned restaurants as of December 30, 2023. We generate revenues by charging royalties, advertising fees and franchise fees to our franchisees and by operating a number of our own restaurants. We plan to grow our business by opening new franchised restaurants and increasing our same store sales, while leveraging our franchise model to create shareholder value. Domestic same store sales have increased for 20 consecutive years beginning in 2004, which includes 5-year cumulative domestic same stores sales growth of 62.2% since the beginning of fiscal year 2019. We believe our asset-light, highly-franchised business model generates strong operating margins and requires low capital expenditures, creating shareholder value through strong and consistent operating cash flow and capital-efficient growth.”

Source: Wingstop

10-K says 5% of franchise sales are added to the national advertising fund and 6% of sales is paid as royalty. System-wide sales minus company-owned restaurant sales is $3,386m. They received $157m for advertising fees in 2023. That’s about 4.6%, roughly in line.

The business model is the exact opposite of Chipotle. The absolute majority of Chipotle restaurants are company operated. They are asset heavy. This is represented in the much higher gross margin. With a revenue of $460m in 2023, gross profit was $222m. That’s 48% gross margin. Just looking at the company owned stores, revenue was $96m from about 45 stores. This means $2m average sales per store. This is exactly in line with what the CEO said on CNBC. Dividing system-wide sales of $3,482m with about 2,100 restaurants yields $1.7m per location, roughly in line. Cost of sales for company-owned stores, including advertising fees (which I’m guessing would be 5% of sales as well) was $70m. This gives a restaurant level gross margin of 26%. 26% gross margin is exactly same as Chipotle’s gross margin. This shows the power of licensing.

Video Summary – CNBC How Wingstop Became One Of The Hottest Restaurant Stocks

– Started as a buffalo chicken wing restaurant in 1994

– IPO in 2015

– 2k+ stores in US. Globally 2300

– Lemon pepper flavor is popular

– Franchisee spend $500k. Make that money in less than 2 years.

cf) For Chipotle, average sales per store is $3m in 2023. Restaurant level margin is 28%. That means $900k profit per year. Say the paypack period is 1.5 years. That means a net profit of $340k per year. I guess it could check out.

– Chicken is all they sell.

– “Menu lends itself well to experiential offering, for hanging out with friends” – less likely to trim spending in this department

– Went beyond chicken wings and went into chicken sandwich in the middle of 2022. Chicken sandwich customers are visiting more frequently. Comp growth 30% in 2Q – The importance of menu expansion

– 11 flavors

– Extremely efficient labor profile. Can operate with as low as 4 people.

– Doesn’t need prime estate since 70% is digital order.

– Brand awareness is growing. viral on social media #wingstop on TikTok

– High p/e: 130x

– Undergoing a transition to a middle to higher income consumer.

– Since 2019, raised 15% in price while peers in quick service restaurant raised 30-40%

– Raised global store count goal to 6k. KFC is 4k stores.

– Average sale per store is $2m.

– 98% of stores are franchised.

Wingstop’s values have a big emphasis on taste.

• Mission: To serve the world with flavor

• Vision: To become a top 10 global restaurant brand.

• Core Values: Service-minded, authentic, fun, entrepreneurial

2. Key elements of recent earnings call & IR materials

From 24Q2 earnings call

– simple fleet of menu

– AUV is over $2m. The new AUV target is $3m.

– Brand awareness is boosting comp growth. In 24H1 comp grew 20%. They see more opportunity since they are still less known compared to other mature brands.

– 24Q2 comp growth of +29% is almost entirely from transaction growth. Digital sales was 68%.

– They developed MyWingstop platform, directing $2.5b sales (I think this would be accumulated sales)

– Franchisees records unlevered cash-on-cash return of 70%

– Aims to expand to 6k stores in US, 10k globally.

– International AUV growth grew 82% in the last two years driven by transaction growth.

– Stock repurchase and dividend payout enabled by the asset light model.

– GUIDANCE: 20% comp growth in 2024

– 2Q comp growth when economy is falling is because people tend to reduce high-frequency occasions. Wingstop is a more indulgent, social occasion.

– Guest frequency is improving to once a month, due to increased new customers, who tend to have higher visit frequency than traditional visitors.

3. If I had to predict the prospects of the business

Wingstop demonstrates the power of licensing and the importance of brand awareness. These two factors contribute to an explosive growth. Store count grows with the tailwind of non-company capital – partners who want to partake in the 70% level margins. Double-digit comp growth while others record much less is enabled by increasing wave of new customers, who tend to visit more often.

The menu space that they operate in – chicken – is highly advantageous. Everyone likes chicken. Buffalo wings is a good party food, midnight snack, booze complement, or a meal on a moderately special night. Their chicken sandwich offering was introduced at the right time, enabling more entry points for those who want a fast food alternative.

I don’t know how this buffalo wing culture would do in penetrating other markets though. For example, when Koreans gather, they already have such a diverse spectrum of social gathering / party food. Buffalo wings isn’t a thing here. I personally was quite surprised to see the consumption scale of chicken wings when I went on a exchange program to the states. The dorm cafeteria would have a buffalo wing Fridays every week and everyone would line up for it. It is one of the go-tos in pubs where there is a screen of ESPN everywhere I look. I think this was quite unique to the US.

These elements combined nailed the best case scenario of an up-and-coming restaurant brand. However, the business is doing so well until now that I should be careful in deciding that this trend would continue.

In order to evaluate this I must

– Keep track of social media trends to see if hype is continued & spread overseas – TikTok analytics, Google trends

– See how big the preference is for chicken wings overseas.

– Check AUV of other fast food restaurant chains to gauge upside.

– Somehow devise a metric to gauge publicity.

– Check penetration into cities compared to peers. I think 6k domestically is a reasonable target though.

– Historical growth trend of comp, driven by transactions.

Written from scratch by Meston Ecoa

May contain incorrect data and information