This post primarily aims to quench my curiosities in the fastest way. Heavily reliant on my judgement and intuition.

Written from scratch by Meston Ecoa

Findings:

Where to See Berkshire's Apple Sell-off Info

Source: cnbc

Introduction

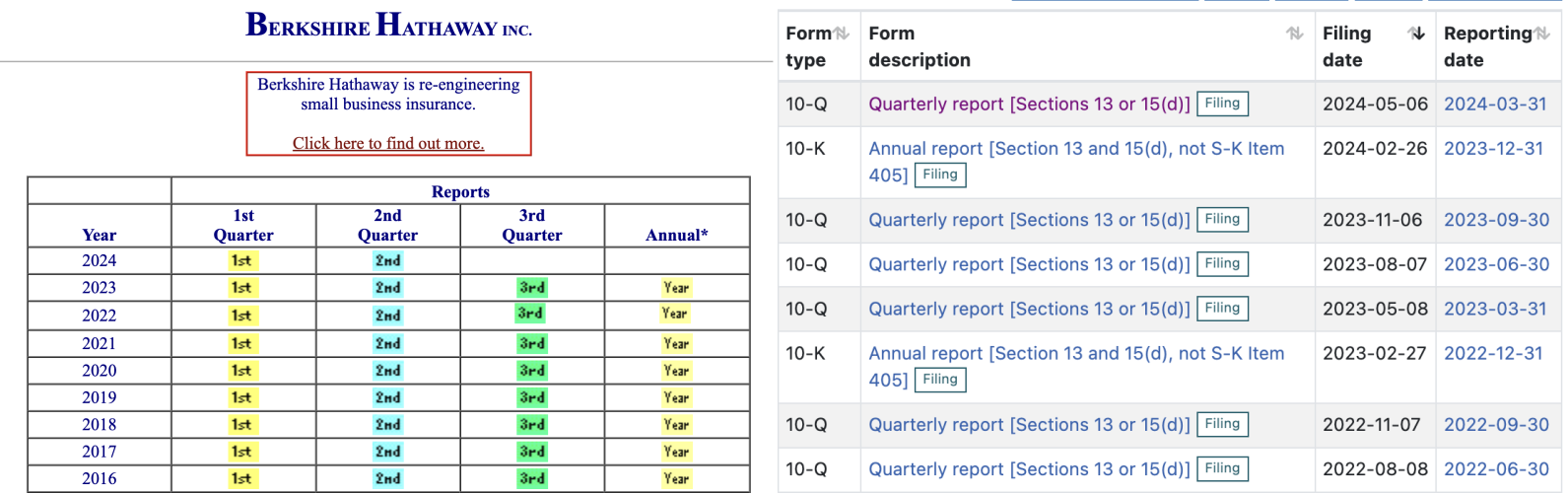

This was an article from Aug 3. That’s a Saturday. I rushed to find the original source. But I couldn’t find it on sec.gov My guess is that it’s because it’s the weekend? I don’t know how customary this practice is, but I was under the impression that sec would be the control tower of information dissemination.

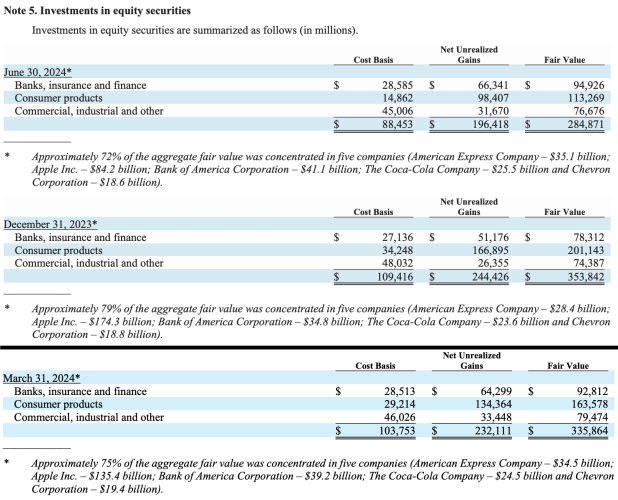

Source: Berkshire Hathaway 10-Q

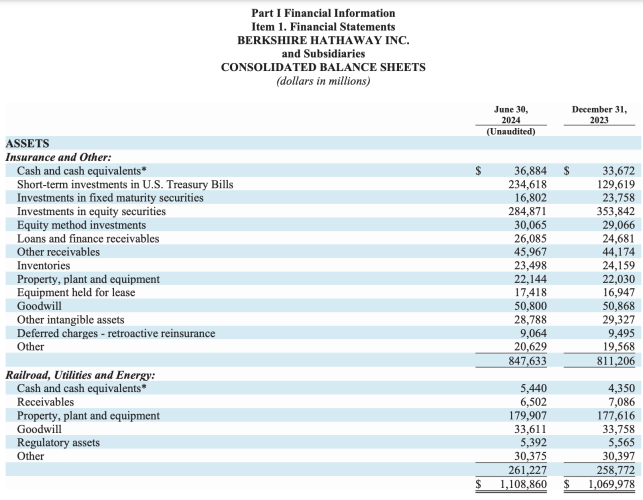

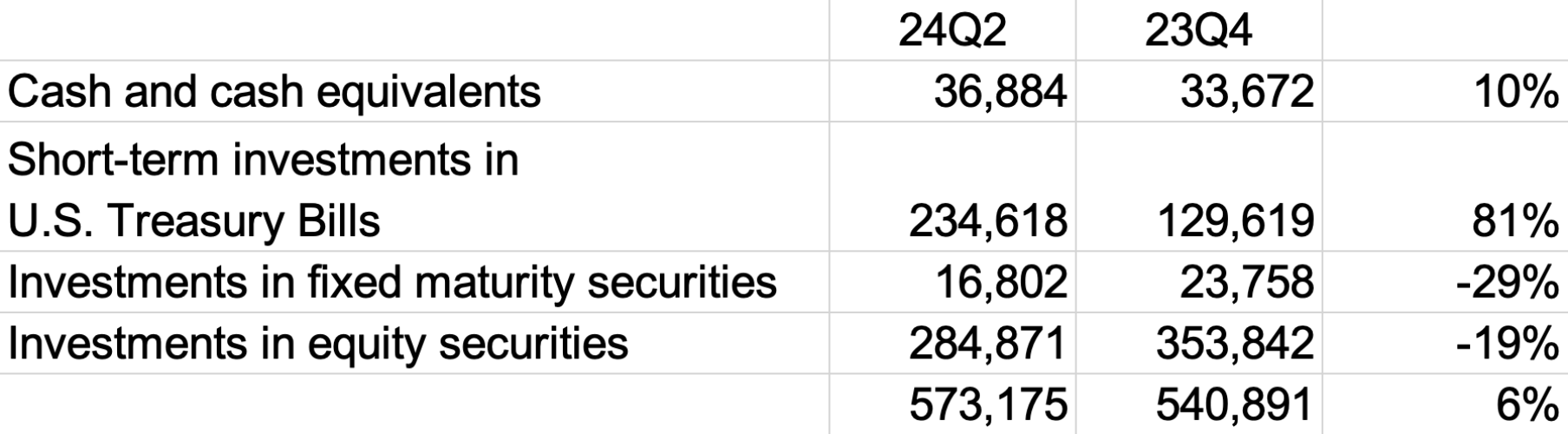

From January to June, SPX grew 15%. BRK.A grew 11%. Buffet’s total assets grew 4%. The first four of entries under Insurance and Other grew 6%. Looking more closely into the first four items under Insurance and Other, the sell-off is more apparent. The company sold off stocks and bought short-term bonds, which still yields 5%.

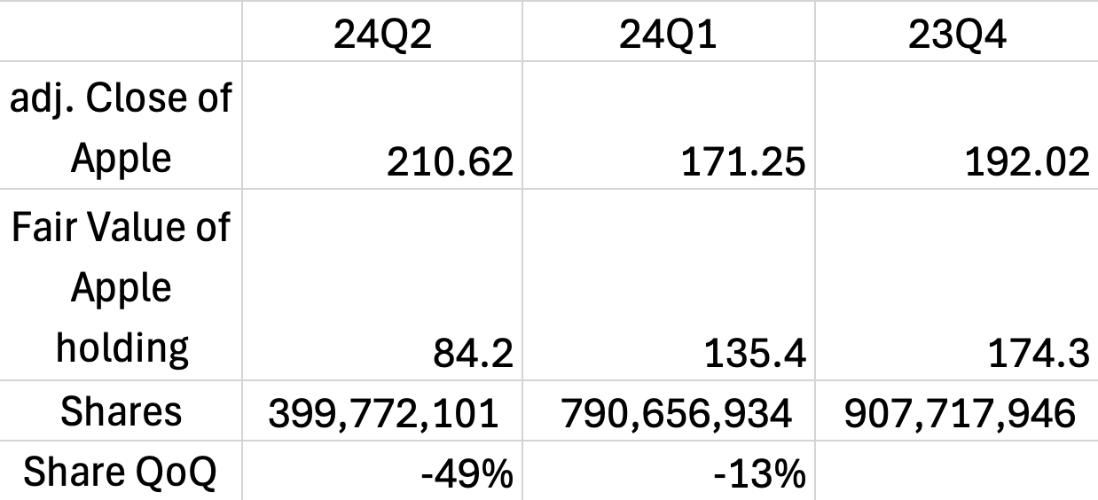

The relevant part indicating the Apple sell off is below. The Fair Value column’s total is the same as what’s shown in the Balance Sheet. $284,871 and $353,842. I added March 31 figures from 24Q1 10-Q.

Written from scratch by Meston Ecoa

May contain incorrect data and information