The objective of this exercise is to research a company to a reasonable depth using a reasonable amount of time, with the belief that a) whatever level of research conducted, there will still remain an area of unknown b) the most efficient way to get better at analyzing is with a manageable single cycle, that gets iteratively better c) getting my hands dirty by covering a breadth of companies will yield a new sense of understanding or at least provide the subsequent sense of direction.

1. How the Business Makes Money

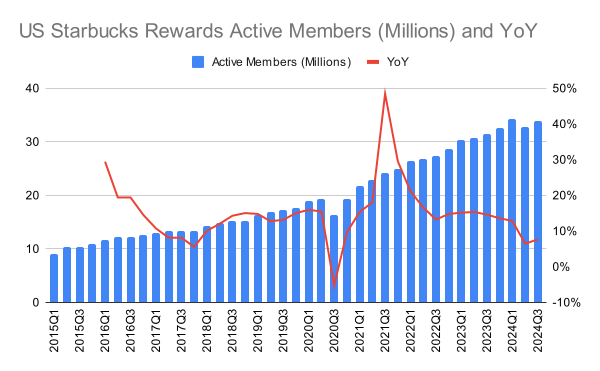

Starbucks stores sell beverages, mainly coffee, and food. During the past 3 years, beverages segment comprised 74% of revenue consistently, food segment 21-22% and “Other” segment 4-5%. In FY 2023, the company recorded $35b in revenue, gross profit of $10b (27%), operating profit of $6b (16%), and net profit of $4b (11%). Serveware, packaged and single-serve coffee, ready-to-drink beverages are part of the “Other” segment. Starbucks, like other restaurant franchises, focused on digitalization accumulating a 90-day active Starbucks Rewards members of 33.8m accounts in the US. About $15b was reloaded and used throughout the year, keeping overall balance of deferred revenue pertaining to stored value cards and “Stars” loyalty program coupons around $1.5b. While most credit is used by the consumer, about $200m is recognized in “breakage” revenue. Although the credit does not have an expiration date, some portion is deemed unlikely to be exercised. This $200m breakage revenue in relation to $6b operating profit, accounts for around 3%.

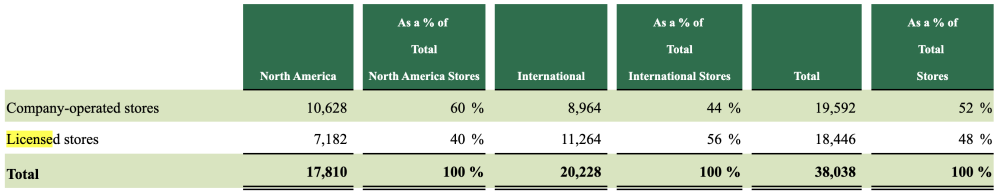

Starbucks operates 38k stores worldwide, with company-operated stores and licensed stores accounting for roughly half each. Stores in North America (17k) and other international (20k) stores each account for half each as well. Meanwhile, in terms of revenue segment, North America accounts for 74%, International 21%, and Channel Development (5%). This would mean that the average store in

North America generates 4.1x revenue than those in other parts of the world. However, since the ratio of company-operated stores to licensed stores is different for the two regional segments, perhaps it is more apt to compare the operating profit. For North America, operating income was $5.5b and for international it was $1.2b. That means NA stores generate 5.4x operating income than international stores. This is quite a significant gap.

Notable countries where Starbucks has a significant presence are

• US: 9,265 company-operated stores & 6,608 licensed stores

• China: 6,019 company-operated stores

• Korea: 1,750 licensed stores

• Japan: 1,630 company-operated stores

• Latin America: 1,549 licensed stores

From this, it seems that their presence in Europe is quite low, given the region’s population and wealth. Statista says as of 23Q3, there were 2,794 stores in Europe, roughly a third of which were located in UK alone. Starbucks mission and strategic priorities are as follows. The level of quality associated with the brand and the publicity is their key strength.

Starbucks mission: “With every cup, with every conversation, with every community – we nurture the limitless possibilities of human interaction”

5 Strategic Priorities: 1. Elevate the Brand 2. Strengthen and Scale Digital 3. Become Truly Global 4. Unlock Efficiency 5. Reinvigorate Partner Culture

Starbucks brought Chipotle CEO Brian Niccol as their new CEO in September 2024, replacing Laxman Narasimhan who occupied the position since September 2022.

2. Key elements of recent earnings call & IR materials

From Q3 FY24 “Earnings at a Glance”

It is evident that the company is sailing through a relatively tough time. Earnings and profitability took a some damage as comp recorded -3%. Non-GAAP global operating margin declined 70bps in this quarter, doing slightly better than last quarter’s -140bps YoY decline. Most notably, same store sales in China looks alarming as it records -14% compared to last year. After two consecutive downward revisions in guidance in the previous two quarters, outlook remained same in this quarter. Same store sales is falling across the world. Revenue is expected to rise in low single digits, presumably led by further expansion of stores. Global store growth is expected to rise 6% compared to the previous year.

Earnings

Source: Starbucks

FY 2024 Guidance

Source: Starbucks

Frustration is evident as the CEO said “We are not satisfied with the results, but our actions are making an impact, leading business and operational indicators are trending in the right direction ahead of our financial results and our runway for improvement is long.”

Growth Strategies

1. Operational Improvement in US stores

Efforts were focused around shortening wait times, higher efficiency during peak hours, and better management of store employees. The efforts were characterized by their “triple shot reinvention strategy” as well as the more recent “Siren Craft System”. The CEO said that “Early assessments demonstrate the capability to drive a 10 to 20 second wait time reduction and a resulting comp

opportunity range of 1% to 1.5%.”

2. Expand US stores

Furthering the business is mainly centered around store expansion in key markets. In line with part 3 of their Triple Shot Strategy, “Become Truly Global”, they plan to expan in Tier 2 and 3 cities. Also, they will open 100 delivery-only kitchens partnering with Gopuff. “Similarly, we are accelerating the pace of our new store builds and renovations with 580 net new builds and more than 800 renovations planned in North America for FY 2024.”

3. Product Innovation

The company will continue to add more menus.

4. Continued Digital Growth

Mobile Order & Pay grew 10% YoY facilitated by removing the need to create an account on the app.

Headwinds

1. Alleged association with Israel leading to boycott

The CEO only briefly mentions the boycott of the brand resulting from to their alleged association with Israel. “Widely discussed misperceptions about our brand” was the term used. This has impacted their operations in Middle East, Southeast Asia, and parts of Europe.

2. China

The more important issue they deem is China. Cautious consumer spending and intensified competition are the hurdles. Regardless of the competition and price war, Starbucks is maintaining their premium brand image. Positive signs such as a rise in SR active members to 22m (+1.6m YoY) and a low employee turnover.

Starbucks blog websites have posts of company’s response of several controversial factors.

Regarding comp, the -7% for international stores being considerably less tragic than China’s -14% is due to strong performance in Japan. The number of stores (company-operated) in China are roughly 4x Japan’s. China accounts for roughly one third of international stores. It would mean that consumers in China faced pressures considerably more than the rest of the world. SR is a key asset that should not be overlooked. US comp recorded -3%, and the -6% comp transaction decline was driven by non-SR members. This shows that SR members’ loyalty is comparatively significant. China’s SR member growth to 22m is promising too.

Source: Starbucks

3. Key Financials and Ratios

Store Growth

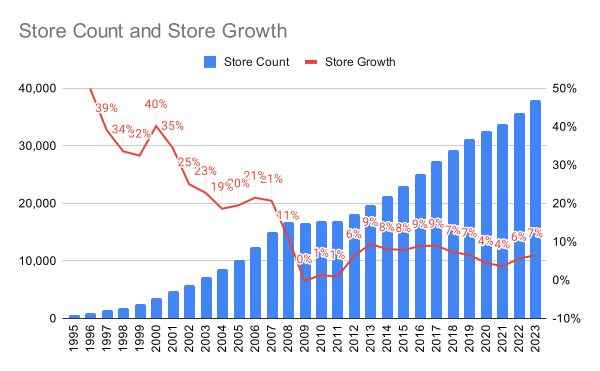

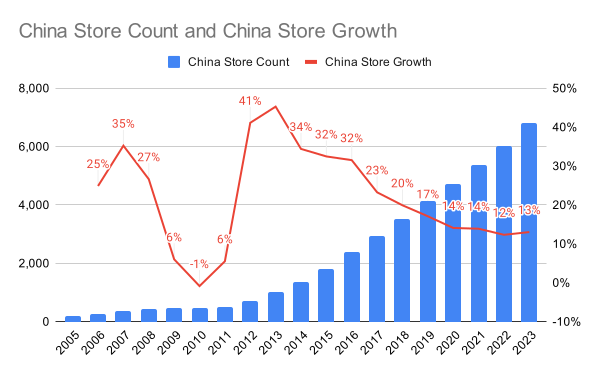

In the early periods of store expansion, Starbucks exhibits a growth rate of around 20-30% YoY. This has fallen to mid-single digit globally. In China recent store growth still records around low-teens.

Starbucks Rewards Active Users

Starbucks Rewards active user growth quite consistently has been in mid-teens. A CAGR of 14%. The users dipped in 2017, years of Covid, and 2024. In Q3 2024, they recorded a growth of 7.6%, much below the long-term average.

Earnings

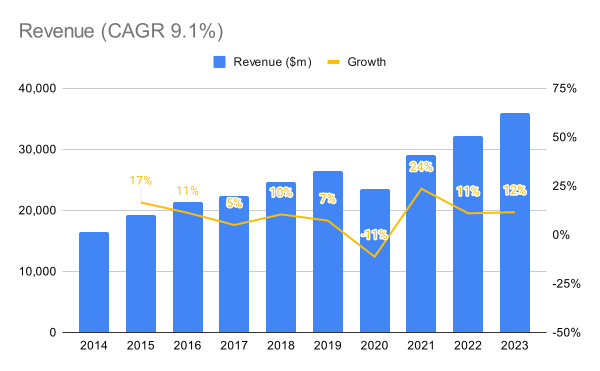

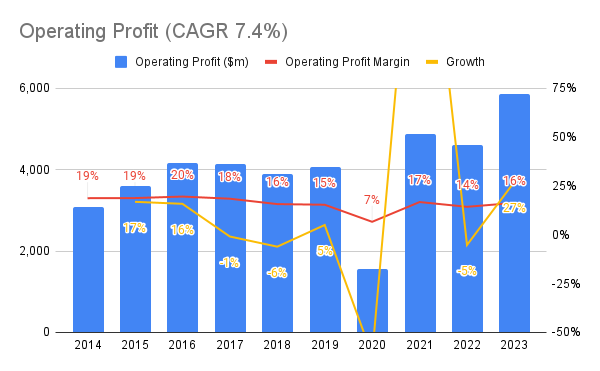

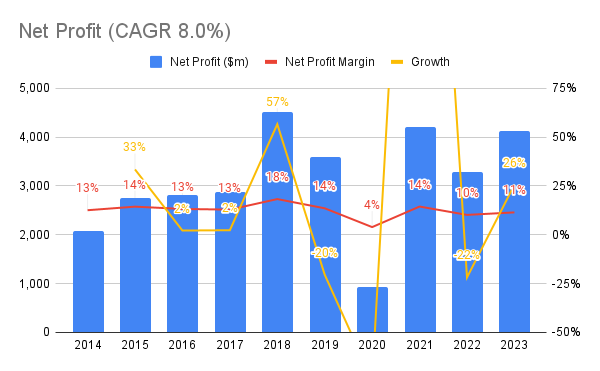

Starbucks has maintained a steady revenue growth of around 9% powered by comp growth and store growth, reaching $36b in FY2023. A noticeable deterioration in operating profit and net profit occurred from 2016 to 2017. Operating profit margin hovers around mid to high teens, while net profit is around mid to low teens.

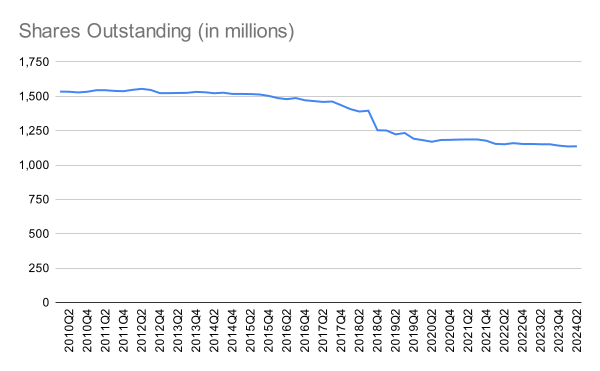

Dividend and Shares Outstanding

With the ability to generate strong, predictable cash flows, Starbucks has never missed a payout in the recent 15 years, and always increased the payout annually. Annualized yield is around 2%. The three years from mid-2015 to mid-2018 is when SBUX shares flatlined, supposedly the same reason as

the drop in operating profit and net profit. In these periods however, the company increased dividends by 5-6 cents per share, as opposed to the typical 2-3 cents annually, and bought back more shares, showing confidence in their business.

Source: Starbucks

Source: Macrotrends

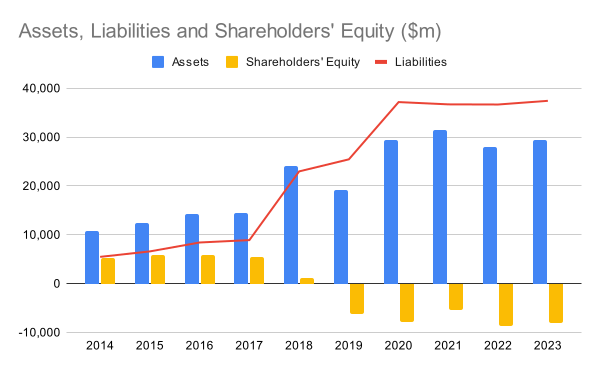

Assets, Liabilities and Shareholders’ Equity

Like many other restaurant chains, Starbucks shareholder’s equity is negative. This is because these businesses with strong cash flows, finance their capital spending with debt. This provisions more to be delivered back to the shareholders, while leveraging the tax deductible

quality of debt. This shows the company’s confidence in their long-term cash inflow. Starbucks debt-to-equity is -3, only above McDonalds, which is -11

Source: Barchart

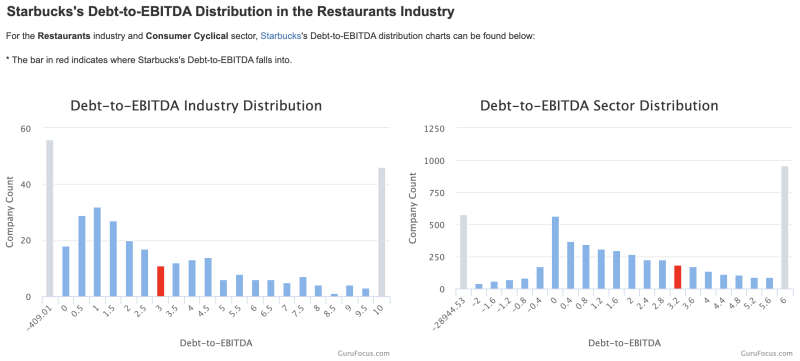

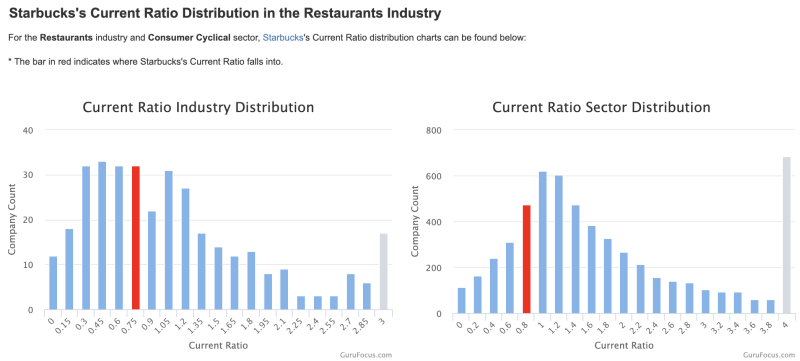

Debt-to-Equity, Current Ratio, p/e ratio

The size of debt in relation to EBITDA is 3.37. It is on the higher-end in the industry. Starbucks revenue is by far the greatest in the restaurant industry. McDonald’s recorded $25b in 2023 (although with double the net income, $8.5b). This is likely because, although having similar store count, 93% of McDonald’s stores are licensed, which makes the revenue from those stores recorded at a lower figure than company-owned stores, but giving a higher margin per dollar. The market cap speaks the profit generating capabilities of the two franchises. This makes sense, since I spend more at McDonald’s than Starbucks per visit. Also, although I visit McDonald’s far less than I would Starbucks,

I’m guessing more people would visit McDonald’s throughout the day than Starbucks.

Quick ratio is about average in the industry, at 0.9. Looking at this shows how structurally sound Chipotle is, on the contrary.

Source: Gurufocus

Source: Gurufocus

Source: Gurufocus

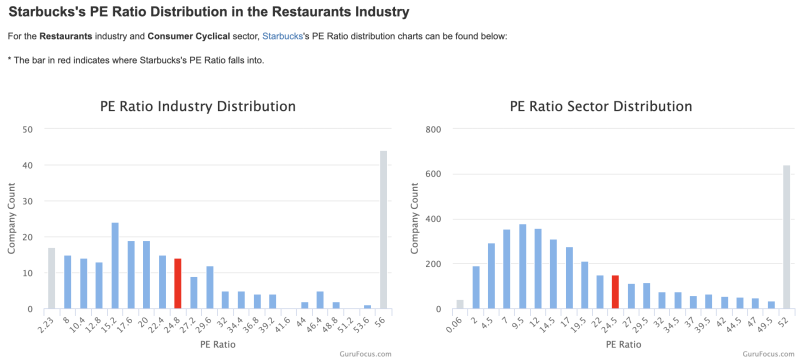

Starbucks p/e ratio is 27x, reflecting that their strong expansion days are behind them. A comparable franchise in maturity would be McDonald’s at 26x, and Domino’s at 25.5x. Fast growing restaurant stocks would have much higher p/e. Chipotle 56x, Wingstop 131x, Shake Shack 172x. When the company was doing great in 2023, p/e reached 30-40x.

Source: bigcharts

Source: Gurufocus

4. If I had to predict the prospects of the business

The brand is widely known and has a premium status. The company is doing a good job with their Starbucks Rewards program, building a loyal customer base.

Starbucks and McDonald’s are two of the biggest restaurant franchises in the world. Fundamentally, this business cannot generate as much revenue as food franchises such as McDonald’s where food is cheap, people leave right after dining, and ubiquitous. Most coffee drinker would maybe buy 0-1 drink per day. 2 at most. On the contrary, everyone needs to eat 2-3 times a day.

I think the key room for growth is 1) comp growth 2) stores growth 3) SR members growth 4) food sales growth. However, comp growth is likely capped near inflation or else the customers will likely go away. Stores growth remains a big element. However, much of the market is tapped already. If the company could somehow expand presence in Europe and India, and fully restore operations in Middle East, things may be a little different. SR members would likely grow at a constant rate, coupled with their initiatives to order without creating an account, which could in turn, lead to more accounts. Food sales accounts for around 20% of revenue. The only way that I think this can materially grow, is if breakfast combo at Starbucks becomes a thing, like McMorning. However, I would think breakfast consumers are typically sensitive to price and unlikely to dine-in. This means, in order to be competitive they would have to offer at a good discount, potentially hurting margins and brand image.

I don’t think the new CEO could offer much to the company, since most issues seem to be tied to the maturity of the franchise. I wonder if he can pull a trick to make consumers believe that the brand is much cooler than it is right now, or make the stores much more prettier. Also, Chinese consumer confidence seems tied to their macro, which will get worse or better regardless of the company’s tactics. I wonder if cutting price of coffee is an option in China. It’s mind-boggling that Chinese prices are higher than the US and most other nations.

As a value stock, I the important points to be on the constant look out would be

1. Is the company undervalued right now?

2. Is their store growth of high-single digits to double digits impaired?

3. Is their premium brand status holding value?

4. Are they tapping into new markets like India, or do they have plan to make Europe sales better?

5. Is China store growth going according to plan? Are the consumers there spending enough?

6. Is the SR active members continuing to grow at a steady pace?

7. Did they come up with a way to sell more food?

8. Is there a new coffee chain that could hurt their market share?

9. Are the coffee drinkers in China and India increasing?

If I had more time to investigate I would

1. Look at previous financials and find out what the company did right or wrong and what situations were favorable or not for the company.

2. See how price reflected the financials and external situations.

3. Get the coordinates of their stores and see room for growth. For example, get the average income of a city, or town. Then get the population of a city or town. Then calculate the current sparseness of the stores.

It would be the best if I could get the historical data for these attributes. It would be interesting to backtest the relationship of expansion and the population/income growth.

Written from scratch by Meston Ecoa

May contain incorrect data and information