This post primarily aims to quench my curiosities in the fastest way. Heavily reliant on my judgement and intuition.

Written from scratch by Meston Ecoa

Conclusion:

1. It would be nice to track what hedgefunds are doing, although with a grain of salt

2. Berkshire also has 41 different stocks.

3. Berkshire also sells in the short run even when they want like it in the long run – e.g. Apple, Bank of America, Chevron.

4. Berkshire also cuts losses when they lose. They bought Hp Inc for $35 and sold for $30. They bought Paramount for $31 and sold for $13.

5. I wouldn’t make an automated tool to analyze 13F myself. It’s not worth it.

6. Hedgefollow is a good website to visit.

Peek into Berkshire's Holdings

Source: hedgefollow.com

Introduction

This will be not be a deep dive (more like a little dive if that’s a word) into Berkshire’s holdings. I know this much. I need to start from 13F. I also know that I need to decide if wrangling the quarterly data into a more convenient form by myself is the right investment. It’ll be nice to establish a pipeline and a set of code that will extract and compare the holdings across time periods, but that’ll take time. For now, I will scope the question as follows.

Q1. How has Berkshire's 1Q24 holdings changed from 4Q23?

Q2. Should I build a tracker myself?

Refresher on 13F

I know of it. I have looked at the document a couple times before. It isn’t part of my workflow

to look into the filing on a quarterly basis, consistently. So from Investopedia.

• Smaller investors frequently use these filings to determine what the “smart money” is doing in the market, but there are serious problems with the reliability and timeliness of the data.

• Managers are required to file Form 13F within 45 days after the last day of the calendar quarter. Most funds wait until the end of this period in order to conceal their investment strategy from competitors and the public.

I think this covers all the basics I need to know. $100mn in assets, 45days, quarterly.

Websites that Aggregate Filings

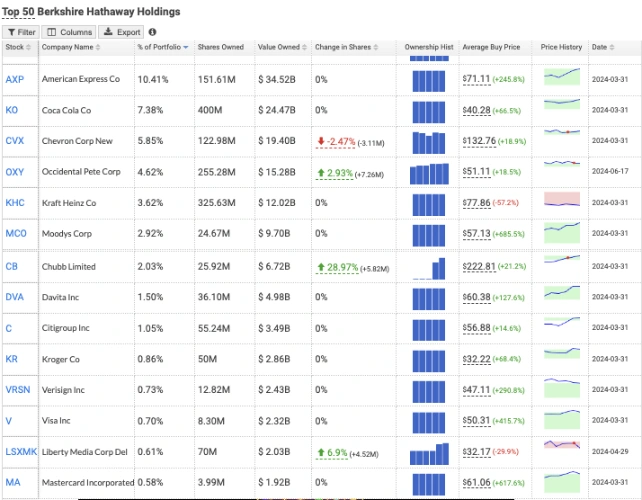

Source: hedgefollow.com

First I want to see how I can achieve the result with minimal time input. Seems like there are good websites that offer good collation of 13F filings. The two are just the top 2 websites that appeared on Google search. hedgefollow.com is nice since it shows all entries of holdings, and arrangable by any of the columns. The downside is that it doesn’t support historical 13F data. Macromicro is nice that it shows reports as early as 3Q18, however only shows top 20 holdings.

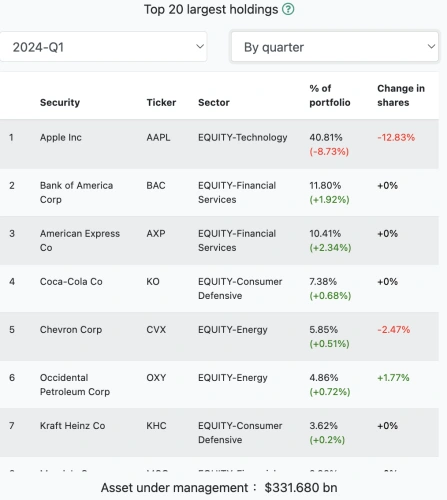

Source: Macromicro

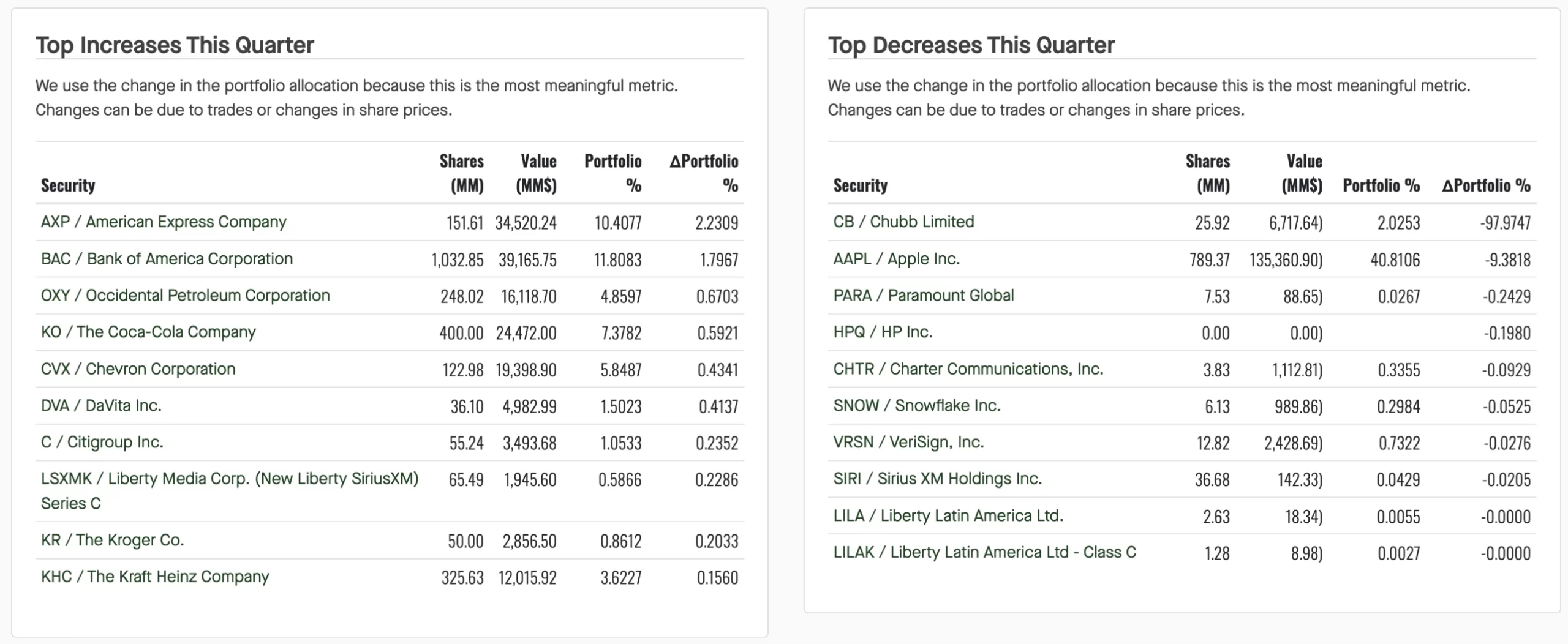

Fintel has a nice page to see the top increases and decreases of the quarter. Also it has a list of “Top Investors” That gives a good summary on presumably the top investors.

Source: Fintel

hedgefollow.com has a Hedge Fund Tracker page that says the following. I guess it doesn’t make sense for me to build a tracker myself. If anything I might build a notifier when a 13F comes out, or when the hedgefollow.com gets updated.

• Passive Investments – 13G: Filed when a fund acquires >5% of a company

• Activist Investments – 13D: Filed in similar cases to 13G, but usually the fund has an activist purpose

• Insider Trades – Form 4: Filed when a fund acquires >10% of a company or acts as an insider

• Quarterly Filings – 13F: Filed quarterly, within 45 days of quarter end, for all funds with >$100M

Let's Actually Look at the Data

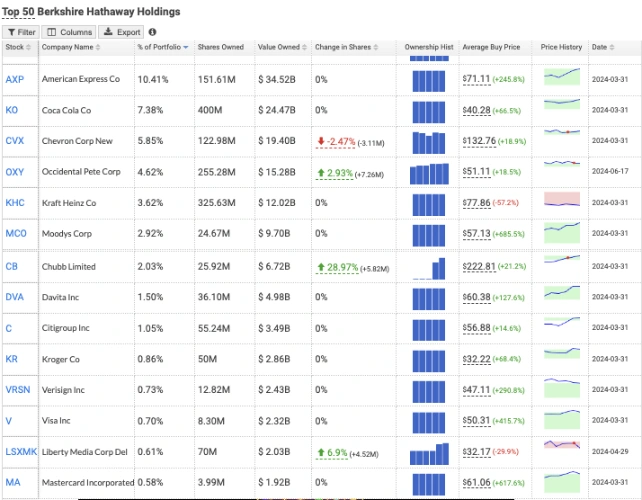

Source: hedgefollow.com

Okay I will stop exploring and actually look in to the data now.

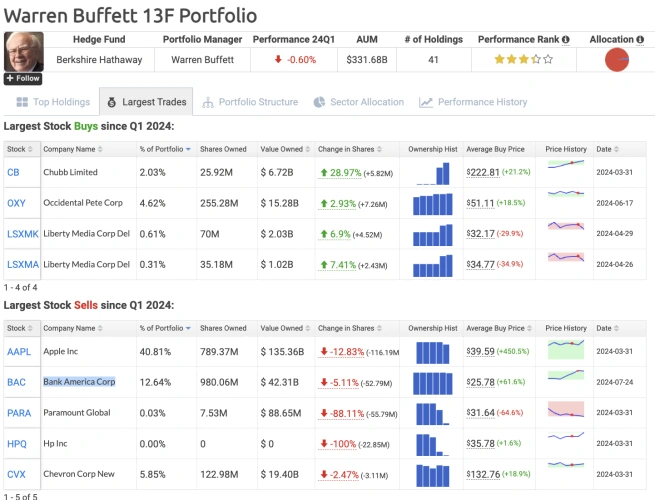

Berkshire Hathaway has positions in 41 stocks with a portfolio value of $331bn. AUM would be $331bn plus cash, which is not disclosed. Its top holdings are Apple Inc (AAPL, 41%), Bank of America (BAC, 12%), American Express (AXP, 10%), Coca-Cola (KO, 7%), Chevron (CVX, 6%), Occidental Petroleum (OXY, 5%)

Its sector breakdown is technology 41%, financial services 31%, consumer defensive (12%), energy (11%). Besides Apple, it doesn’t have much stake in technology sector.

I guess this is in line with prior knowledge I have of Warren Buffet. Buy wonderful companies at a fair price – companies with a good track record and has an enduring moat. What I find notable is that the spectrum of 41 stocks seems somewhat large for a person who does not prefer diversification. He said before that it is crazy to own 50 stocks. “Three wonderful businesses is more than you need in this life to do very well.” 41 seems awefully closer to 50 than to 3.

I’m thinking some scenarios

#1. When you are running that great a sum, maybe 3 stocks isn’t a big enough playground in terms of mkt cap & float. (but even so, Berkshire holdings of Apple only account for 5.15%, surely it could handle Berkshire’s wagers if it wanted to?)

#2. Other portfolio managers like to play a different strategy. Possibly trading at a higher frequency of stocks of a greater spectrum?

#3. Maybe the old man primarily plays the long game, but spots opportunities that pertain to the shorter term?

I guess it’s possible that the oracle could spot enough lucrative #3 opportunities, but those playgrounds probably couldn’t take Berkshire’s position since it is too big. I think I remember reading something like that. He used to buy fair businesses at a wonderful price, but his shift to buying wonderful businesses at a fair price is how he really grew big. Maybe the man still finds fair businesses at a wonderful price and can’t resist them?

These are all guesses. There’s probably answers on the web somewhere, but my time is limited. I’m all for making guesses now right.

Seems like change in % of portfolio and change in shares are both important. Fintel says “We use the change in the portfolio allocation because this is the most meaningful metric. Changes can be due to trades or changes in share prices.” But I disagree. As a person who wants to learn how and when trades were executed, seeing the change in shares is meaningful. Say the stock rose 10%, and Bershire sold 10%. That means the portfolio allocation is almost unchanged. But seeing that this institution sold their

position is something to look into. Are they starting to capitalize on the investment? Did they simply spot a better opportunity? Was there a short spike too good to refuse? Why peer into the greats, if you’re not even going to peer properly?

Another thing I’m noticing is that Macromicro and Fintel says BAC accounts for 11.8% of Berkshire, while Hedgefollow says 12.64%. This is particularly interesting since it seems Hedgefollow takes into account more than just 13F. And in form 4 filing on July 24, Berkshire sold 18 million shares, which means it would have orginally accounted for even more than 12.6%.

My conclusion on this matter is this.

1. Fintel and Macromicro only takes into account 13F, which means it’s only correct on the day of the reporting

2. Hedgefollow follows other reports as well, which gives a more comprehensive overview.

3. Regarding BAC, it seems the reason is due to the rally since May 15 (date of 13F). As BAC rallied, its % of portfolio gradually increased from 11.8% to above 12.6%. Last week, as market entered correction, the company offloaded the position from 7/22 to 7/24.

4. Form 4 must be filed within 2 business days. Maybe it could be a prompt and good indicator to see the reactions of major players.

Source: hedgefollow.com

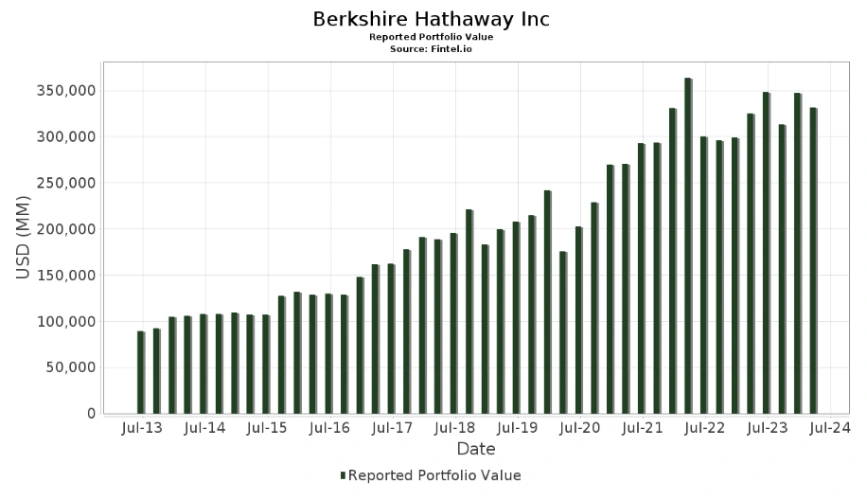

Also this shows that he racked up a lot more in cash. He sold a lot more than he bought. Basically he unloaded Apple, BAC, Paramount, HP, Chevron and bought energy companies and media companies. Maybe it’ll be interesting to plot below against SPX and market PE ratio. My hypothesis is that when PE reaches a certain levelthe holdings would drop. Note these holdings are exclusive of cash.

Source: hedgefollow.com

What’s the takeaway then

1. It would be nice to track what hedgefunds are doing although with a grain of salt

2. Berkshire also has 41 different stocks.

3. Berkshire also sells in the short run even when they want like it in the long run – e.g. Apple, Bank of America, Chevron.

4. Berkshire also cuts losses when they lose. They bought Hp Inc for $35 and sold for $30. They bought Paramount for $31 and sold for $13.

5. I wouldn’t make an automated tool to analyze 13F myself. It’s not worth it.

6. Hedgefollow is a good website to visit.

Written from scratch by Meston Ecoa

May contain incorrect data and information