This post primarily aims to quench my curiosities in the fastest way. Heavily reliant on my judgement and intuition.

Written from scratch by Meston Ecoa

Mt. Gox Repayment Impact on BTC?

Source: Investing.com

Introduction

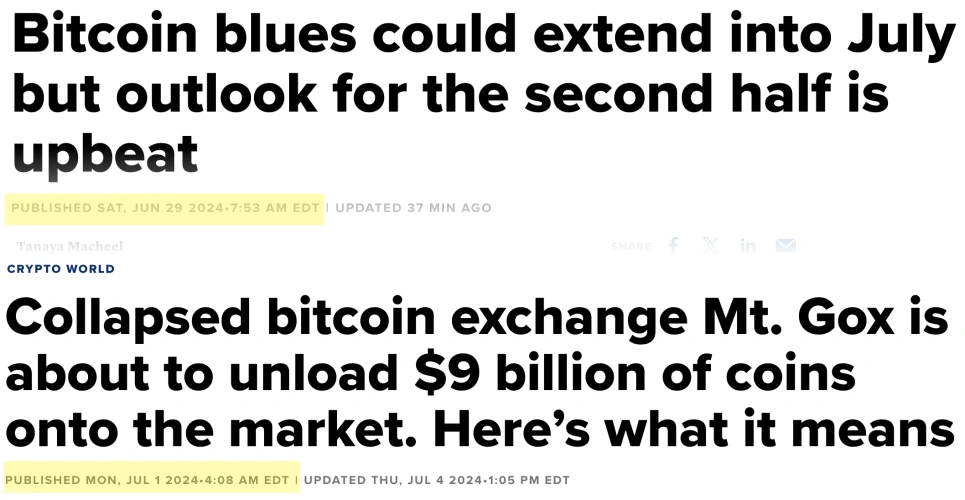

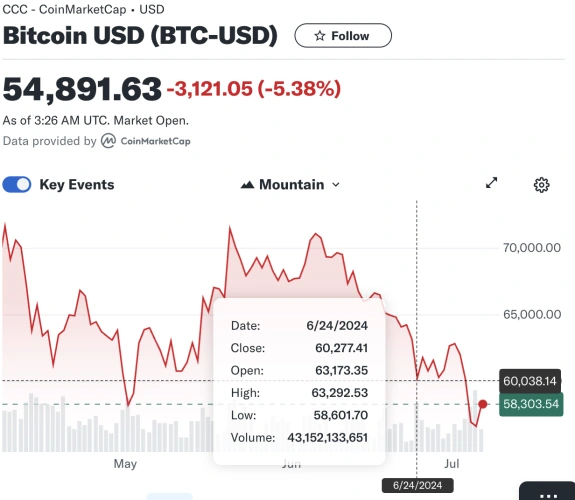

Crypto is tanking. Early June BTC was $70k, now $55k. Mt. Gox repayment buzz started a month ago. Official announcement was on June 24. I only knew about it on July 2. I need to know better. Around July 5 I lamented not having bought SBIT, the 2x inverse BTC ETF from iShares. Right now (July 8) I’m thinking buying SBIT on July 2 would have proved lucrative, but such investment decisions could yield havoc in other cases. Meaning, buying on July 2 would could also be too late as the news is spread too much already. In order to justify my holdings in crypto, I should have at least, some basic background knowledge. I hope it leads to foreknowledge as well.

Source: Investing.com, beincrypto.com

There’s a saying, gotta sell on the news right? Here, I decided to ask these questions.

Q1. What is the Repayment Timeline?

Q2. What is the Repayment

compared to total float?

Q3. Why is Germany selling Crypto

all of a sudden?

Q4. How can I be alerted of critical news before mass public knows?

142K BTC - STARTING JULY - TAKES UP TO 90DAYS

Source: The Block

Timeline is important here. It will tell how much opportunity there was. It will also tell the level of promptness it will require.

• June 1, CryptoPotato

“Analysts from the market intelligence platform CryptoQuant say the recent bitcoin (BTC) moves by the defunct crypto exchange Mt. Gox are no cause for alarm and would cause no immediate selling pressure on the digital asset.”

• June 24, Mt. Gox

Source: Yahoo Finance

Evidently, market was aware since late May. Crypto specific media were covering the topic. The official announcement came in June 24 and of course media covered the announcement, such as the one from Coindesk. Crypto price seems to reflect the impact. There was a sharp drop on June 24, but it sinked all throughout June.

I wanted to check out how much coverage it got on CNBC and Bloomberg. Finance media that are not exactly crypto-centric. It really didn’t give off much buzz. Especially amid all the other flashy important-looking news that it has to compete with. Bloomberg did mention the topic on May 31. Hats off to them. The takeaway here I guess is that if you really care about an asset, follow asset specific media. As Robert Kiyosaki would say, you gotta buy assets you love, or else you won’t take care of them.

Q1. What is the Repayment Timeline?

Mt. Gox has officially started repaying creditors as of July 5, in line with their announcement in June 24. The Block says “The trustee has previously detailed that the timeline for payouts to become visible in creditors’ accounts may vary depending on the exchanges. Kraken is given 90 days to process payouts, while Bitstamp may take up to 60 days. BitGo will have payouts visible within 20 days. SBI VC Trade and Bitbank will both complete payouts within 14 days.” In essence it’s important to tract repayment status and evaluate how much it leads to a selloff in the coming months.

Source: InvestorPlace

Q2. What is the Repayment

compared to total float?

Investorplace says repayment will be 142k Bitcoin (BTC) and 143k Bitcoin Cash (BCH). According to Coinmarketcap the float of BTC is 19.72 million. 142k is 0.7% of total BTC in circulation. Sources would often cite how much that is in dollar term, but I guess it doesn’t have much meaning since it’s dependent on current trading price. I think % of float is more important. 0.7% was actually quite smaller than I expected. Crypto News Flash states in June 17, that impact of repayment should be small since some 1 million BTC selloff of Grayscale Bitcoin Trust and other Long term holders caused minimal price disruption. 142k is significantly smaller than 1mn. FYI, Mt. Gox got hacked in 2014, reportedly losing 650k-850k BTC. The exchange was able to find 200k BTC back.

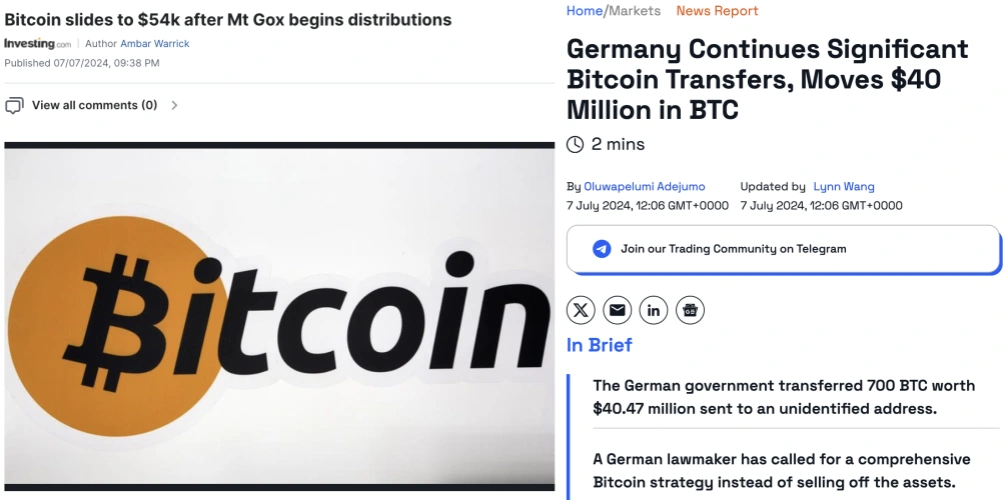

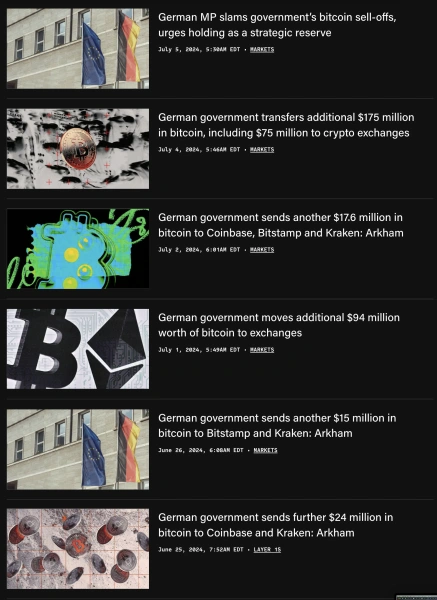

Buzz on Germany

Source: The Block

I searched relevant news on The Block. They seem to have plenty crypto news. Apparently, Germany has been doing a series of sell-offs as the price tanked, and most recently a German congressman criticized it. Mitrade mentions a tweet from @ki_young_ju. I have no idea how respectable this opinion is but here it is. “Govt #Bitcoin selling is overestimated. $224B has flowed into this market since 2023. Government-seized BTC contributes about $9B to the realized cap. It’s only 4% of the total cumulative realized value since 2023. Don’t let govt selling FUD ruin your trades – Ki Young Ju (@ki_young_ju) July 5, 2024” I guess everyone has their opinion.

Q3. Why is Germany selling Crypto

all of a sudden?

My guess is that the country got alarmed by the drop in price. I couldn’t know for sure.

Arkham - Where I can see Transactions!

Source: Arkham U.S

Many websites cited Arkham. A lot. Turns out it’s where I can see all the transactions. I did know that blockchain transactions are visible to everyone. This is the first time visiting the website though. It was pretty intuitive. Interestingly wallets of big entities were identified there already. Accounts such as US government, German government, Mt. Gox all had their wallets already identified. I guess certain big transactions, although anonymous, is recognizable who the sender and recipient is. And series of these transactions further reveal more and more entities. I won’t get into the inner workings of the “how”, but just use it.

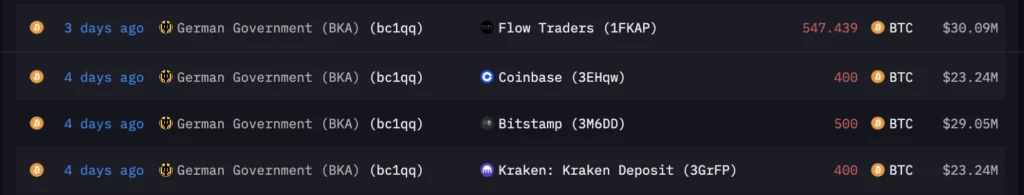

Source: Arkham Germany

Source: Arkham Mt. Gox

Q4. How can I be alerted of critical news before mass public knows?

Indeed I can see some interesting points myself.

• Mt. Gox indeed sent 1545 BTC to Bitbank 3 days ago. It started to repay on July 5! It’s current holdings is 141.687K BTC, exactly the amount that it said it will repay.

• Germany indeed transferred constantly to exchanges.

Here is what I did. I set up an transaction alert on Arkham of Mt. Gox. My guess is that the next transfers would reach 142k BTC in the coming months. Depending on the repayment progress I will evaluate when to get back into crypto. Also, I have added two crypto specific media to my bookmark

Written from scratch by Meston Ecoa

May contain incorrect data and information