This post primarily aims to quench my curiosities in the fastest way. Heavily reliant on my judgement and intuition.

Written from scratch by Meston Ecoa

Findings:

6. BRK’s total assets reach $1t, while AAPL’s total asset is around $300b. Making BRK’s price/book 1.5x, while APPL 50x.

7. Reinvesting dividends is very important.

8. Buying Berkshire means I buy Coca-Cola, See’s Candy, The Buffalo News, etc. These are Buffet’s “marriages” and personal attachments, not mine. Unless I like the marriage, I don’t need to get into it.

Berkshire's Asset Allocation

Introduction

Berkshire holds $270b in cash? and that accounts for 30% of his portfolio? This was the impression I got from a quick glance at its balance sheets. If this is true how on earth is it beating market performance? Does it mean I should also have 30% cash in my portfolio? I gathered data from 10-K documents from 2002 to 2023. My goal is to get some insights from Berkshire’s asset allocation.

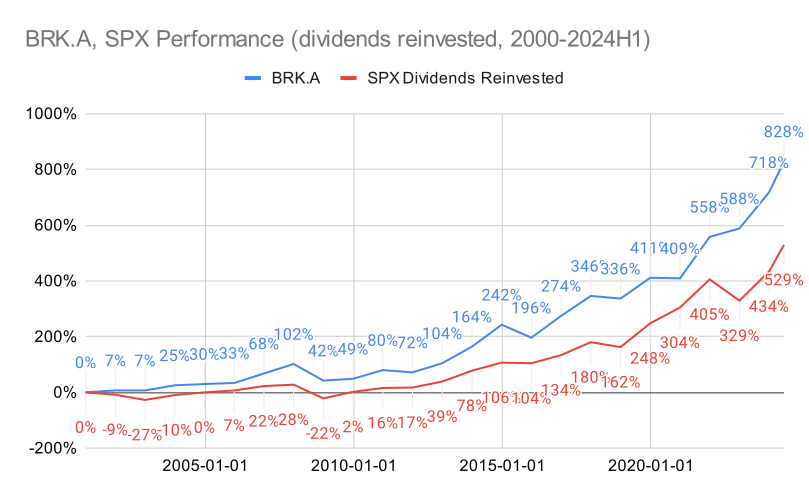

Let’s start here, by looking at how successful the return is on this company. It has grown 9-fold in 24 years. S&P 500, with its dividends reinvested, grew around 6-fold. Berkshire’s market cap is $930b as of

August 2024. These figures give me a sense of what to expect, if I don’t plan on picking stocks myself. Buying the market, or buying the greatest holding company of all time, would yield something like this. Not 2x every year. Of course, picking stocks could go both ways.

Source: sec.gov

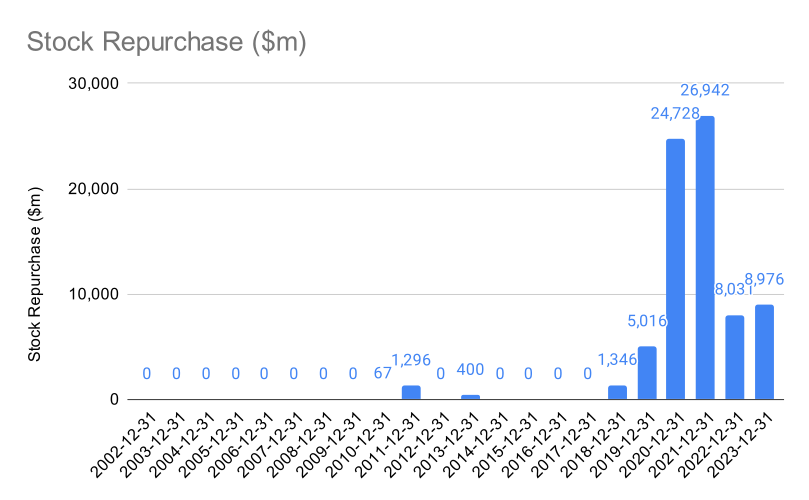

Note that Berkshire, doesn’t pay dividends. It will repurchase shares, only when they have sufficient cash AND they deem its shares currently undervalued. Therefore, it is only fair to compare it to the dividends-reinvested figure of a market index. Here, I assumed 15% dividend tax on an annual basis. SPX’s annual dividend rate is right around 1.8% in the past 24 years.

Source: sec.gov

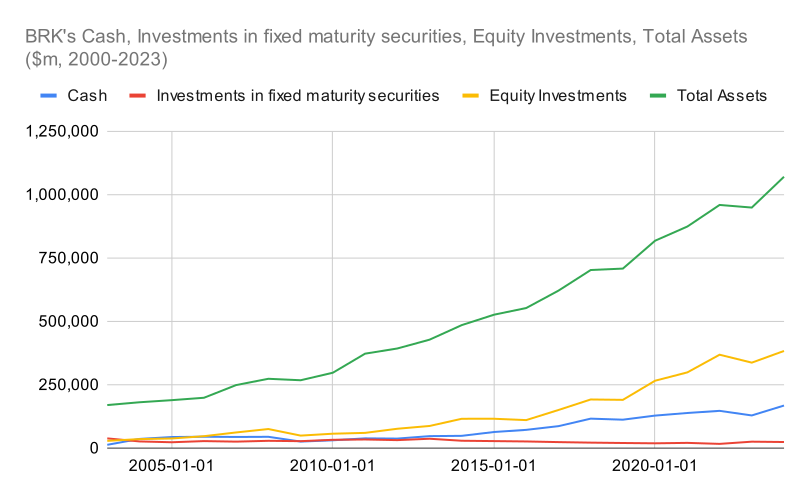

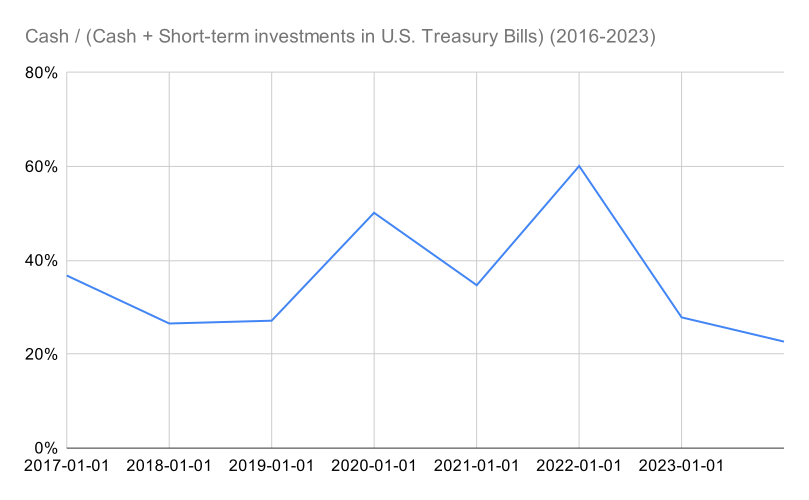

Here, cash includes cash equivalents and short-term investments in U.S. Treasury Bills as well.

Equity Investments for sure does not represent all of Berkshire’s businesses. For example, See’s Candy or their railroad business, which they have 100% ownership of, will not be shown here. It wouldn’t be shown in their 13F filings as well.

Source: sec.gov

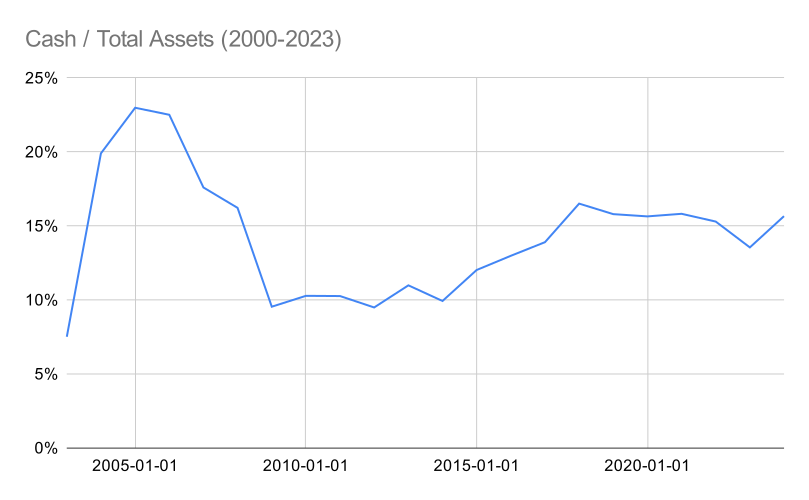

Cash accounts for around 15% of total assets, just to provide a sense.

Source: sec.gov

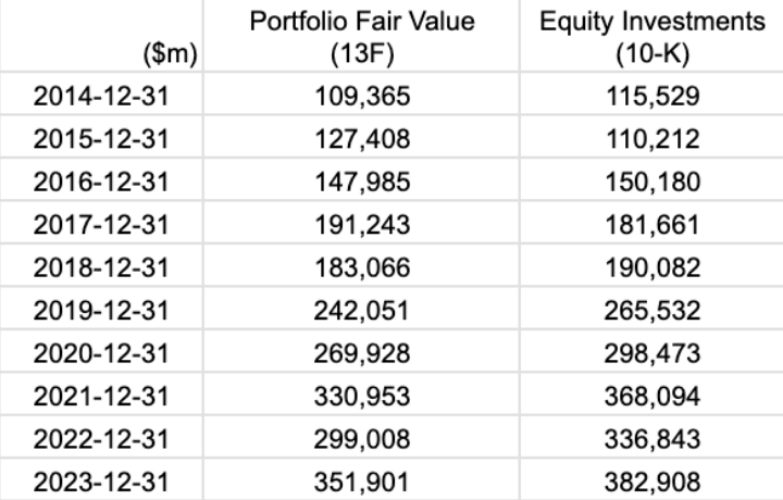

This is the comparison between 13F and 10-K. While I hoped to see perfect alignment between the two, I guess this counts as not too far off. In one annual shareholder meeting, one person asked if Berkshire is comfortable having Apple take up 50% of their portfolio. Warren Buffet answered that it is not true. It is apparent that the person mistook the sum of fair value in 13F as Berkshire’s entire portfolio.

Well, a bit like the audience member, I also did want to investigate Berkshire’s “investments” which only includes companies whose operations are out of their control, and not included in their book. Perhaps this is more comparable to an individual investor’s point of view. For example, their railroad company’s property, plant and equipment are included in their consolidated balance sheets, but Apple’s ppe is not.

Source: sec.gov

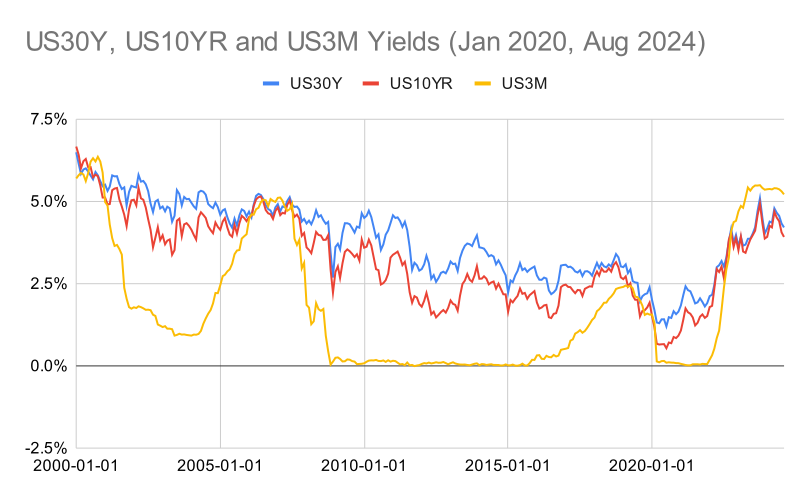

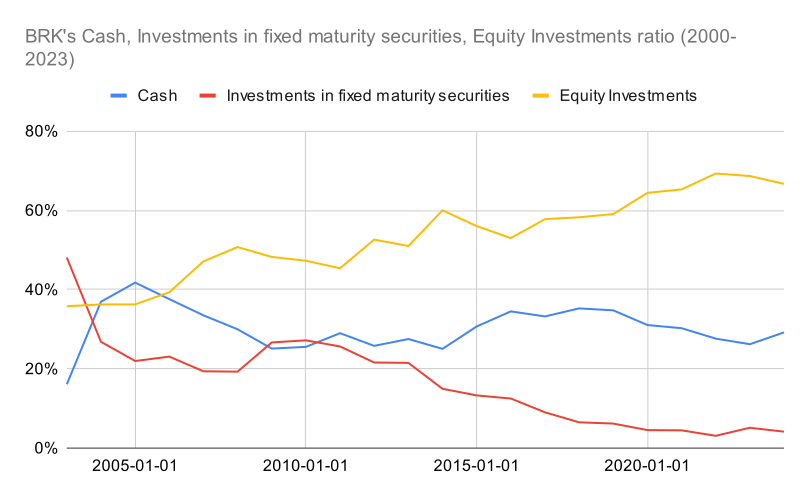

Note that in the chart above, the percentages of each period would add up to 100%. In this case, cash accounts for roughly 30% all all times, with equity investments on the rise, and bonds on the fall. (This is where I got the idea that Warren Buffet’s portfolio has 30% cash almost all the time.)

This makes sense, since bond yields are constantly on the downtrend. In the 80s, it used to be around 10%. Also, in times of inflation like 2023 and 2024, short-term treasuries a favorable place to park cash as they more directly reflect policy rates.

Source: sec.gov

Warren Buffet seems to like parking cash in short-term treasuries a lot. Real cash usually accounts for roughly 33% of his very liquid assets.It’s was really quite mind boggling, how a portfolio with so much cash outperforms SPX. Think about it. You put 100% of your money that you have set aside for investing into stocks and bonds. And this guy, who only put in 70% of his money in stocks and bonds continuously outperforms the market? It doesn’t make sense right?

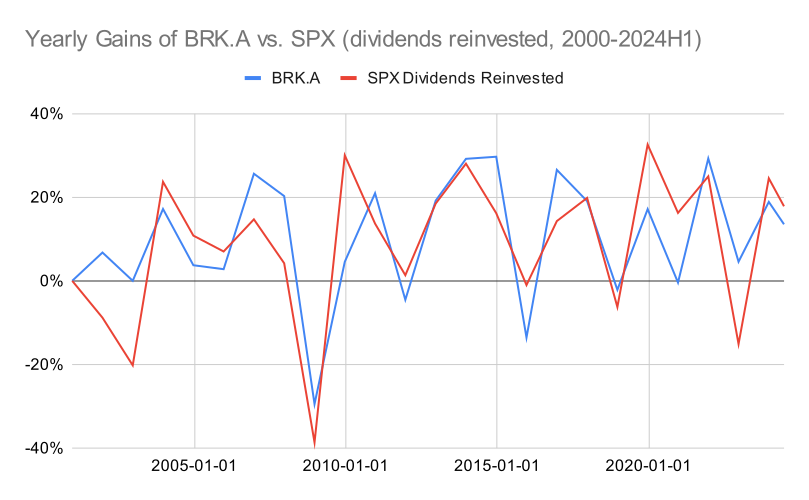

Not only is his long-term return better, but the yearly variance is lower. The standard deviation of yearly return is 14.8% for Berkshire and 17.43% for S&P 500. In the year of 2008, Berkshire’s share price dipped -29%, while SPX plunged -39%. (This is another point too. It’s not like Warren Buffet would have recorded a net gain in 2008. Legends take hits too. But they probably prepare in advance, and adapt faster afterwards.)

To understand this, I think it’s important to understand that his cash and cash equivalents are not identical to cash in our brokerage accounts. When the media says Berkshire piled up some $276b in cash in 24Q2, these will never be deployed in its entirety to scoop up stocks when the market crashes.

For example, in 24Q2 10-Q of Apple. They have $25b in cash and cash equivalents. Their total asset is $331b. No one assumes Apple is readying to scoop up $25b once the market plunges. The level of cash would increase for individual companies, if they expect less liquidity or payment failures in the coming days. (I just realized how little Apple’s assets are compared to Berkshire. Apple’s price/book is 50x, while Berkshire is 1.5x)

From the articles, I wondered why Warren Buffet doesn’t buy IVV or QQQ with all the cash that’s sitting around. But that was foolish. We don’t expect Apple to invest all $25b cash in the stock market.

I also wondered why Berkshire doesn’t sell Coca-Cola, or even its fully-owned businesses like See’s Candy clearly when they were able to spot an opportunity like Apple. This lecture gave me the answer.

“In terms of wholly owned businesses, we’re not going to sell no matter how much anybody offers this for me. If somebody offers three times what something is worth, See’s Candy, Buffalo news, whatever it may be, we’re not going to sell it. I may be wrong in having that approach. I know I’m not wrong if I owned 100% of Berkshire, because that’s the way I wanna live my life. … To do that simply because somebody waives a big check at me would be like selling one of my children, because of a big check.”

So this answers my question. Since I have attached the video. I want to add two more of his points mentioned here. (That is repeated in many other places.)

• “Someone once said the chains of habit are too light to be felt until they’re too heavy to be broken.”

• There were 2,000 companies in the auto industry in the 1920s and only 3 survived. For TV and the airline business, also, the industry grew, but nobody made money. His view of the internet business was the same at the time of the lecture. Computer is a marvelous thing, “but I don’t know who’s going to win. Unless I know who’s going to win, I’m not interested. … Defining your circle of competence is the most important aspect of investing. It’s not how important how large your circle is. You don’t have to be an expert on everything, but knowing where the perimeter of that circle of what you know and what you don’t know is and staying inside of it is all important.”

While acknowledging the oracle’s emphasis on integrity, goodwill, and prudence, I, on the contrary, remind myself to not drown in it. Berkshire does have many many investments that last less than a year. It bought and sold TSMC within a quarter. Berkshire also traded Snowflake, IBM and Apple. They also make mistakes. They also on average hold 40 different stocks at any given moment. Furthermore, I should be mindful that when I’m buying Berkshire stock, I’m also buying companies of his personal attachment. He wouldn’t sell See’s Candy and buy S&P ETFs or more Apple. I admire his respectfulness of his “financial marriages”, but they are his, not necessarily mine, unless I want to make it mine, i.e. by investing in Berkshire.

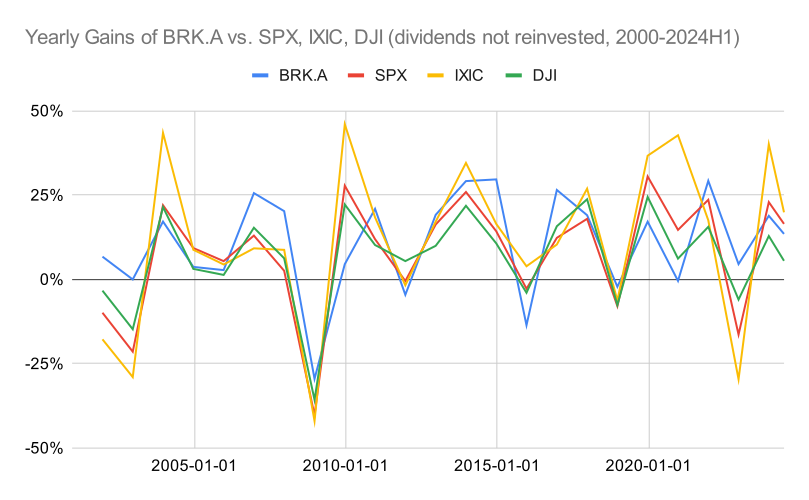

Source: Google Finance Google Sheets API

This chart doesn’t reinvest dividends, which again, is fine for BRK, but not for the other indices. In this competition, BRK beats all indices. However, Nasdaq grew 660% without reinvestment. I’m guessing it would exceed Berkshire’s performance if dividends are reinvested, but I didn’t have data. Anyhow, how Berkshire manages to grow at such a rate, without investing in the latest tech stocks, with lower volatility is quite amazing.

Written from scratch by Meston Ecoa

May contain incorrect data and information