Markets

Headlines and Quotations

CNBC

Trump: ‘I think we’ll have a deal with India’ on tariffs and trade

Trump complained to Bezos before Amazon said it scrapped idea to display tariff cost

- Within hours of the call, Amazon publicly downplayed the scope of its plan — and then announced that it had been scrapped entirely.

Starbucks stock falls as sales disappoint, turnaround pressures earnings

- Starbucks on Tuesday reported weaker-than-expected earnings and another quarter of same-store sales declines, but the coffee giant said its turnaround strategy is showing early signs of success.

- Some of those tweaks include scaling back plans to automate more coffee-making and investing more in labor, which weighed on earnings during the quarter.

- While Starbucks is spending more on labor, the company is cutting back on how much it is putting into equipment.

UK announces draft rules for crypto industry, touts greater collaboration with U.S.

- Speaking at a fintech event Tuesday, U.K. Finance Minister Rachel Reeves announced plans for a “comprehensive regulatory regime for crypto assets

Oil industry that Trump wants to ‘drill, baby, drill’ has taken a beating since he took office

- U.S. crude oil

prices have fallen below $65 per barrel, down more than 20% since Trump’s second term began, making it unprofitable for many companies to boost production, according to a survey by the Federal Reserve Bank of Dallas.

Super Micro shares dive after server maker issues weak preliminary financials

Investing.com

Stock market today: S&P500 ends higher on trade deal hopes; big tech earnings eyed

- The S&P 500 closed sharply higher Tuesday for the sixth-straight day, underpinned by falling Treasury yields and signs of flexibility on tariffs from the White House as well as signs of further trade deals just as the earnings season continues to heat up.

Headlines and Quotations

CNBC

China insists no tariff talks underway with Trump and Xi or top aides, despite U.S. claims

- “Let me make it clear one more time that China and the U.S. are not engaged in any consultation or negotiation on tariffs,” Chinese Foreign Ministry spokesman Guo Jiakun said at a press conference.

Treasury Secretary Bessent says it’s up to China to de-escalate trade tensions

“I believe that it’s up to China to de-escalate, because they sell five times more to us than we sell to them, and so these 120%, 145% tariffs are unsustainable,” Bessent said during an interview on CNBC’s “Squawk Box.”

Temu adds ‘import charges’ of about 145% after Trump tariffs, more than doubling price of many items

- For example, a summer dress sold on Temu for $18.47 will cost $44.68 after $26.21 in import charges are added to the bill, a 142% surcharge

Donald Trump Jr. co-founds new private members club, Executive Branch, with a $500,000 fee

DOGE cuts could help Elon Musk companies avoid $2 billion in liabilities: Senate report

- The memo finds that as of Inauguration Day, Musk and his companies were facing at least 65 “actual or potential” actions from 11 federal agencies. Many of those threats are now neutralized.

International students are rethinking U.S. study plans amid visa policy shifts, experts say

Investing.com

Dow, S&P 500 gain on tariff deal hopes and into mega cap earnings

Reuters

DeepSeek available to download again in South Korea after suspension

IBM to invest $150 billion in US over next five years to aid quantum push

WSJ

Wall Street Banks Sell Final Slug of Elon Musk’s X Debt

- In the end, banks found a graceful exit from the $13 billion in financing that weighed on them for some two-and-a-half years.

U.S. Jet Fighter Is Lost Overboard in Latest Mishap Involving Aircraft Carrier

- A jet fighter fell off the aircraft carrier USS Harry S. Truman and sank Monday when the ship made a sharp turn

Spain, Portugal Hit by Sweeping Blackout

- Big power swings caused Spain’s system to disconnect from the European grid

- Europe’s highly connected power grid, designed to pool power between countries and increase resilience, can be a double-edged sword, he added. “This interconnectivity also means that disruptions can spread quickly across national borders,” Becerra said.

Markets

Headlines and Quotations

WSJ

Meta’s ‘Digital Companions’ Will Talk Sex With Users—Even Children

- they banter over text, share selfies and even engage in live voice conversations with users.

- To boost the popularity of these souped-up chatbots, Meta has cut deals for up to seven-figures with celebrities like actresses Kristen Bell and Judi Dench and wrestler-turned-actor John Cena for the rights to use their voices

Driver Hits Crowd at Vancouver Festival, Killing 11 People

Ukraine’s Crimea Lies at the Heart of Russia’s Invasion—and Trump’s Peace Plan

- For over a decade, successive U.S. administrations, including Trump’s first, decried Russia’s armed seizure of Crimea in 2014 and said they would never recognize the land grab—but did little to help Kyiv get it back.

Trump, Zelensky Meet for First Time Since Oval Office Shouting Match

Zelensky said they discussed a full and unconditional cease-fire as well as conditions for a lasting peace. He added it had the potential to become a “historic” meeting and thanked Trump.

- Trump later criticized Russian President Vladimir Putin in a post on social media, threatening to hit Moscow with further sanctions.

China’s Huawei Develops New AI Chip, Seeking to Match Nvidia

- Huawei hopes that the latest iteration of its Ascend AI processors will be more powerful than Nvidia’s H100, a popular chip used for AI training that was released in 2022

Bloomberg

Trump floats new income tax cut in bid to ease tariffs bite

- President Donald Trump suggested Sunday that his sweeping tariffs would help him reduce income taxes for people making less than $200,000 a year, as public anxiety rises over his economic agenda.

Treasury market’s ‘new world order’ brings fear of the long bond

Markets

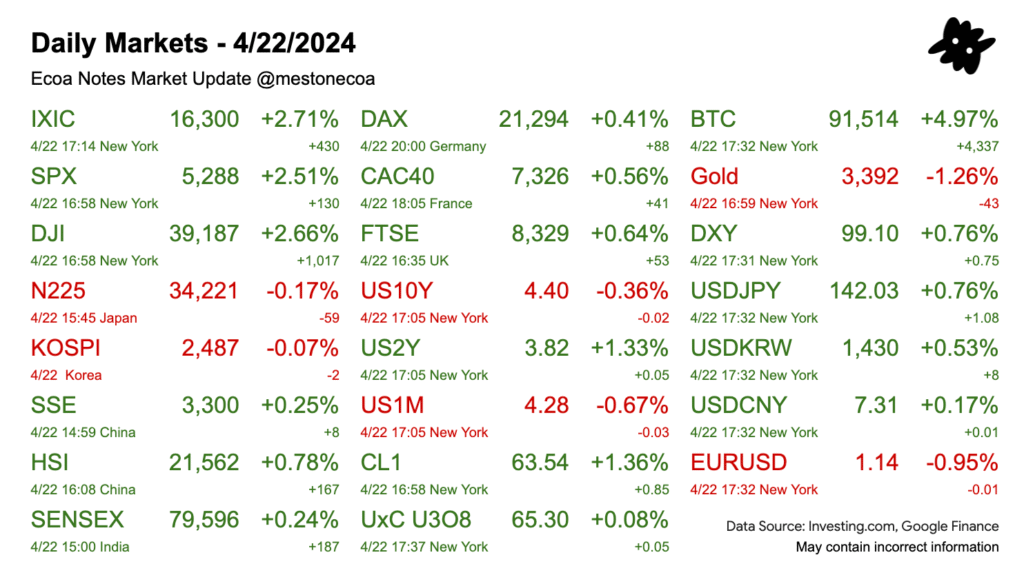

The U.S.-China tariff war continues to de-escalate, with China reportedly reducing tariffs on select U.S. semiconductors. Tech stocks surged, with $NVDA up 4.3% and $TSLA gaining 9.8%. More tech earnings are expected, potentially with highlights of tariff impacts on individual companies. $BTC soared past $95k.

Headlines and Quotations

WSJ

Trump Administration Lays Out Roadmap to Streamline Tariff Talks

- The U.S. is looking to negotiate within the new framework with about 18 major U.S. trading partners on a rolling basis over the next two months, the people familiar with the matter said. The initial plan is for six nations to come in for talks in one week, six nations in a second week, and six nations for a third week of talks—an 18-nation cycle that would then repeat until the administration’s self-imposed July 8 deadline. At that point, reciprocal tariffs would hit nations that can’t reach a deal, unless Trump further extends his 90 day pause.

Pentagon Prepared Briefing for Musk on Top Secret U.S. Weapons for China War

- Top Pentagon aides were developing a briefing for Elon Musk last month on more than two dozen highly classified weapons programs for fighting China until the department’s top lawyer intervened, people familiar with the plan said.

Yahoo Finance

Tariff uncertainty creeps into tech earnings

- And with Meta (META) and Microsoft (MSFT) set to report their earnings on April 30 and Amazon (AMZN) and Apple (AAPL) scheduled to report on May 1, expect to hear even more about tariffs very soon.

Google was far more tight-lipped about what tariffs will mean for its bottom line next quarter, outside of the de minimis commentary. That said, if tariff concerns begin to force advertisers to pull back on their ad budgets, Google could find itself in trouble.

Tesla stock surges 9.8%, clinches 18% weekly gain after DoT unveils new self-driving car rules

- “This Administration understands that we’re in a race with China to out-innovate, and the stakes couldn’t be higher,” said Transportation Secretary Sean Duffy.

- CEO Elon Musk said on the company’s earnings call this week that Tesla expects to be “selling fully autonomous rides in June in Austin, as we’ve been saying for now several months. So that’s continued.”

Reuters

China criticizes US for ‘recent abuse’ of tariffs

- People’s Bank of China Governor Pan Gongsheng said in a statement at the conclusion of the International Monetary Fund’s steering committee meeting.

China exempts some goods from US tariffs

- China has exempted some U.S. imports from its 125% tariffs and is asking firms to identify critical goods they need levy-free, according to businesses that have been notified, in the clearest sign yet of Beijing’s concerns about the trade war’s fallout. The dispensation, which follows de-escalatory statements from Washington, signals that the world’s two largest economies were prepared to rein in their conflict, which had frozen much of the trade between them and raised fears of a global recession.

CNN

China quietly rolls back retaliatory tariffs on some US-made semiconductors, import agencies say

China appears to have quietly rolled back retaliatory tariffs of 125% on some semiconductors made in the US, according to details provided to CNN on Friday by three import agencies in the southern technology hub of Shenzhen, as Beijing tries to soften the blow of an ongoing trade war on its all-important tech industry. The exemptions apply to integrated circuits, also known as microchips or semiconductors, according to the agencies. They found out about the exemptions, which have not been officially announced, on Thursday.

Markets

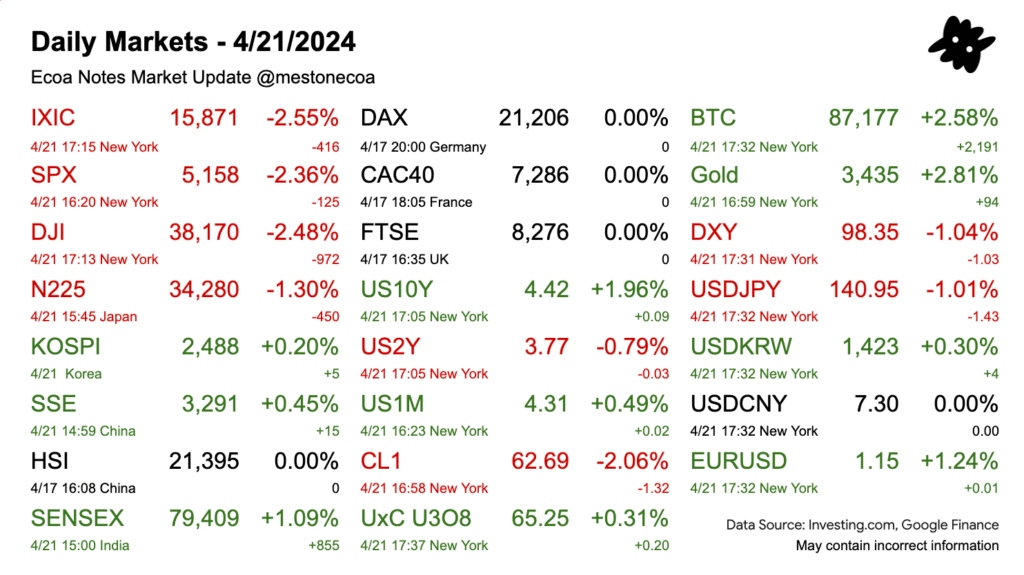

Markets rose for the third day coming out of Easter. Trump has backed down, saying active negotiations with China was underway. Chinese officials denied any progress in conversations. Nonetheless, market seems satisfied by lower possibility of a hard face-off.

Headlines and Quotations

WSJ

Russian Attack on Kyiv Kills 12, Prompting Trump to Rebuke Putin

- “I am not happy with the Russian strikes on KYIV. Not necessary, and very bad timing. Vladimir, STOP! 5000 soldiers a week are dying. Let’s get the Peace Deal DONE!”

Ukraine agreed to a U.S.-proposed cease-fire 44 days ago, but Russia declined.

Google’s Earnings Power Holds Up in Global Turbulence

- Parent company Alphabet reported operating income of $30.6 billion for the first quarter on Thursday—solidly beating Wall Street’s forecast of $28.7 billion.

Home Sales in March Fell 5.9%, Biggest Drop Since 2022

- So far this spring, supply is increasing faster than demand. The inventory of homes for sale is rising, because some sellers who have been waiting for mortgage rates to fall have decided they can’t keep waiting. The average rate on the standard 30-year fixed mortgage was essentially flat this week at 6.81%, according to mortgage-finance giant Freddie Mac.

Trump Tariffs News: Stocks Gain; China Says Not in Trade Talks With U.S.

- Tech stocks are climbing, helping boost the Nasdaq in particular. Momentum began with hope earlier this week that the Trump administration is softening its stance on China and the Federal Reserve.

China Says Not in Trade Talks With U.S.

- China hasn’t engaged in trade talks with the Trump administration, Chinese officials said, denying reports the world’s two largest economies have started negotiations.

President Trump: ‘Actively’ Talking to China on Trade

Xi Is Ratcheting Up China’s Pain Threshold for a Long Fight With Trump

Pepsi and Mountain Dew Depend on Imports. PepsiCo Says Tariffs Will Hurt Earnings.

- Unlike rival Coca-Cola, PepsiCo makes the concentrate for nearly all of its U.S. sodas in Ireland. That concentrate is now subject to a 10% tariff. Both companies also could be hurt by a 25% tariff on aluminum imports.

Reuters

Meta cuts jobs at its Reality Labs division

Facebook owner Meta Platforms is laying off an unspecified number of employees from its Reality Labs division amid ongoing restructuring efforts, the company said on Thursday.

US aims to boost offshore oil drilling by easing pressure rules

- Under the new rules, operators working in the Wilcox rock formation under part of the waters that Trump has renamed the Gulf of America, can produce oil from multiple offshore reservoirs using greater pressure differences.

- Grok:

Downhole Commingling: This is a technique where oil from multiple underground reservoirs (layers of rock containing oil) is extracted through a single well. Each reservoir may have different natural pressures due to geological conditions.

Pressure Differential: The difference in pressure between these reservoirs is called the pressure differential. For example, one reservoir might have a pressure of 10,000 psi (pounds per square inch), while another has 8,500 psi, resulting in a 1,500 psi pressure differential.

Why It Matters: If the pressure difference is too large, it can cause technical issues, such as oil flowing unevenly, damage to the well, or safety risks like equipment failure.

Bloomberg

Apple to Strip Secret Robotics Unit From AI Chief Weeks After Moving Siri

- As part of the robotics project, Apple plans to release a tabletop robot that uses an artificial limb to move around an iPad-like display.

- Apple plans to relocate the robotics team from John Giannandrea’s AI organization to the hardware division

Investing.com

TSX closes higher, continuing gains of prior session

Markets are also looking ahead to a key election in Canada on April 28, with both of the top candidates vowing to fast track energy projects to help diversify oil exports away from the United States.

- Trump’s tariffs and his talk of turning Canada into the 51st U.S. state have sparked widespread outrage in the country and underpinned a national discussion around diversifying its energy supplies.

Headlines and Quotations

WSJ

White House Considers Slashing China Tariffs to De-Escalate Trade War

- Trump: “Various elements built it up to 145, but it won’t be anywhere near that high. … It’ll come down substantially, but it won’t be zero.”

- One senior White House official said the China tariffs were likely to come down to between roughly 50% and 65%. The administration is also considering a tiered approach similar to the one proposed by the House committee on China late last year: 35% levies for items the U.S. deems not a threat to national security, and at least 100% for items deemed as strategic to America’s interest, some of the people said.

Trump Meets His Match: The Markets

- Yet so far, the only force that has reliably prompted him to back down is Wall Street.

Trump Signs Executive Order Targeting University Accreditors

- Grok: University accreditors are organizations that evaluate and certify the quality and standards of higher education institutions and their programs. In the U.S., they are typically private, nonprofit entities recognized by the U.S. Department of Education or the Council for Higher Education Accreditation (CHEA). Their role is to ensure institutions meet criteria for academic rigor, faculty qualifications, student outcomes, and operational integrity.

- “Instead of pushing schools to adopt a divisive DEI ideology, accreditors should be focused on helping schools improve graduation rates and graduates’ performance in the labor market,” said Education Secretary Linda McMahon.

- Accreditors play a role largely unseen to the public but crucial for universities, setting standards that must be met to access federal financial aid

Trump Shoots Down Millionaire’s Tax Trial Balloon

- President Trump tossed cold water on the idea of raising tax rates on the highest-income Americans, ending for now a Republican flirtation with higher taxes at the top to help pay for his broader agenda.

Fearing Trump’s Visa Crackdown, College Students Race to Scrub Op-Eds

- Students—particularly those without U.S. citizenship—are asking to have their names removed from articles for fear of backlash by immigration officials.

Yahoo Finance

Stock market today: Dow, S&P 500, Nasdaq futures trade flat as Wall Street pins hopes on trade deals

- US stock futures traded flat after a mostly upbeat day on Wall Street, driven by fresh signs President Trump is aiming to strike a trade deal with China.

Chipotle shares drop as it reports first same-store sales decline since the pandemic

- It’s same-store sales declined 0.4% year over year, the first drop since COVID-19 shut down stores in 2020 Q2. Analysts had expected growth of 1.74%; it had clocked a 7% jump in the same period last year.

- “As we dig into specifically what’s going on with the Chipotle consumer, we’re not seeing a loss of customers. What we are seeing is a convenience challenge, meaning we need to build more restaurants as quickly as we can to get to our 7,000 restaurants in North America.”

Reuters

Dinner with the president: Trump meme coin surges on offer to top buyers

- President Donald Trump’s meme coin surged more than 60% on Wednesday after a post announcing “the most EXCLUSIVE INVITATION in the world” promised the top 220 buyers of $TRUMP a private gala dinner with the president on May 22.

Dollar rebound loses steam with trade in focus

South Korea prosecutors indict ex-president Moon Jae-in for bribery

Prosecutors had been investigating whether Lee’s appointment as the head of the SMEs and Startups Agency was in exchange for Moon’s former son-in-law getting a job and receiving a salary plus living expenses at the Thai-based corporation that Lee controlled in 2018-2020, the statement said.

CNN

Elon Musk is going back to Tesla. But is the damage already done?

- Musk told investors on Tuesday night he would step back from his role running the Department of Government Efficiency (DOGE) next month, spending only one or two days a week there. He said he would spend the freed up time running Tesla.

- Musk on Tuesday dismissed the idea that there had been any brand damage due to his controversial political activities, blaming the protests – without any proof – on paid protestors. He suggested the company’s record drop in sales was due to macro economic issues and uncertainty on the part of car buyers.

CNBC

- Data from the Bank of Korea showed that the drop was mostly due to a fall in construction, with the sector contracting 12.4% year on year.

Nvidia supplier SK Hynix warns of demand volatility after quarterly profit soars 158% on AI boom

Markets

Powell did not even need to budge in response to Trump’s rate-cut pressure. Trump said today that he is not planning on sacking Powell. More importantly, Bessent mentioned in a close-door meeting hosted by JP Morgan that tensions with China will de-escalate. Trump also admitted that tariffs against China will drop, but not to zero. Equities climbed on the news. $TSLA reported disappointing earnings, but Musk’s intention of significantly reducing time at DOGE as well as prospects of robotaxis rolling out provided good consolation. $DXY gained slightly. $Gold retreated. $BTC roared above $90k instantly.

Headlines and Quotations

WSJ

Trump Says He Has ‘No Intention’ of Firing Fed Chair Powell

President Trump said he is not planning to fire Federal Reserve Chairman Jerome Powell—and he signaled that tariffs on China could be lowered. “I would like to see him be a little more active in terms of his idea to lower interest rates … but, no, I have no intention to fire him,” he told reporters in the Oval Office.

Bessent Tells Investors He Expects Trade Tension With China to De-Escalate

- Treasury Secretary Scott Bessent on Tuesday reassured attendees of a closed-door JPMorgan investor summit that he expects the trade war with China to de-escalate

Tesla Profit Sinks, Hurt by Backlash Over Elon Musk’s Political Role

- Tesla’s net income slid 71% in the first quarter

Tesla’s Global Vehicle Deliveries Sank 13% in First Quarter

- Back to 22Q3 levels

Stock Market Today: Stock Futures Jump After Trump Says He Has No Plans to Fire Fed Chair

Ukraine’s Zelensky Pushes Back on U.S. Peace Plan

- Ukrainian President Volodymyr Zelensky pushed back on a U.S. proposal to recognize Russia’s control of Crimea as part of a cease-fire agreement

Consulting Firms Offer to Cut Up to $20 Billion From Federal Contracts

At least two firms offered 7% to 10% discounts on their labor costs within existing contracts, while others provided credit proposals of $100 million toward their work. At least one company offered free deployment of AI agents within the government to make it easier for federal agencies to work together.

CNBC

Chinese freight ship traffic to busiest U.S. ports, Los Angeles, Long Beach, sees steep drop

- For the week ending May 3, the number of freight vessels leaving China and headed to the Southern California ports, the main U.S. ports receiving Chinese freight and other Asian trade, is down 29% week-over-week, according to Port Optimizer

Sam Altman steps down as Oklo board chair, freeing nuclear startup to work with more AI companies

- “As Oklo explores strategic partnerships to deploy clean energy at scale, particularly to enable the deployment of AI, I believe now is the right time for me to step down,” said Altman.

Investing.com

USD weak unless proven otherwise, says Macquarie strategist

- Shvets suggested that the longstanding view of the U.S. dollar as a strong currency might need re-evaluation.

Trump considering $5,000 ’baby bonus’ to boost declining U.S. birthrates – NYT

- This is just one idea the Trump administration is considering to boost America’s declining birthrate, the report stated.

Bloomberg

Amundi Says Clients Are ‘Massively’ Repositioning Into Europe

- It’s the latest example of the “sell-America” sentiment gripping markets, as even investors once seen as bullish on US stocks sound the alarm.

Markets

Headlines and Quotations

WSJ

Stock Market Today: Dow and Dollar Drop on Jitters Over Fed and Trade

- Trump on Monday demanded lower rates in a post on social media, saying costs are trending downward and the economy could slow “unless Mr. Too Late, a major loser, lowers interest rates, NOW.”

Harvard Is Suing the Trump Administration

Justice Department Urges Tough Action to Break Google’s Search Dominance

- Judge who found the company maintained an illegal monopoly is asked to force it to sell its Chrome web browser

Russia Welcomes U.S. Proposal to Deny NATO Membership to Ukraine

CNBC

U.S. dollar falls to three-year low as Trump’s Powell threats further dent investor confidence

Tesla shares tumble ahead of first-quarter earnings report

- Oppenheimer analysts wrote in a note out Monday that “ongoing brand erosion” for Tesla in the U.S. and Europe is weighing on sales already, but a “bigger issue for the company is potential weakness in China demand and margin impact due to the Trump tariffs.”

Pope Francis, the first pontiff from the Americas, dies at 88

Trump hosts Walmart, Target and Home Depot CEOs for tariff meeting

- About two-thirds of what Walmart sells in the United States is made, grown or assembled in America

- Target, on the other hand, is in a tougher spot. The Minneapolis-based retailer is best known for discretionary merchandise like inexpensive, chic clothes and home goods, products that are typically manufactured overseas.

Investing.com

Trump’s call to fire Powell is ‘self-defeating’

Reuters

Japan’s Nomura to buy Macquarie’s US, European asset management units for $1.8 billion

- The acquisition gives Nomura immediate scale across Western markets through Macquarie Asset Management’s (MAM) equities, fixed income, and multi-asset investment capabilities, along with established client relationships in key financial centers.

China warns countries against striking trade deals with US at its expense

- Beijing will firmly oppose any party striking a deal at China’s expense and “will take countermeasures in a resolute and reciprocal manner,” its Commerce Ministry said.

Yahoo Finance

Tesla stock slides ahead of crucial Q1 earnings report with sliding sales, Musk’s DOGE role in focus

- The big concern for Tesla’s bread-and-butter auto business is demand. Earlier in April, Tesla reported Q1 deliveries of 336,681 units versus 390,342 estimated

- Earnings to be released tomorrow.

AP

FTC sues Uber, alleging it signed up Uber One subscribers without their permission

- alleging that it enrolled consumers in its Uber One subscription program without their consent and made it too difficult for them to cancel the service.

Headlines and Quotations

CNBC

Trump draft executive order would make sweeping changes to the U.S. State Department

- The draft executive order proposes the elimination of all “non-essential embassies and consulates in Sub-Saharan Africa” and the consolidation of regional bureaus around the world.

It also calls for terminating offices and positions within the department focused on climate, women’s issues, democracy, human rights, migration and criminal justice.

- “Preemptive purchasing” by businesses, as well as consumers, of big-ticket items at pre-tariff prices may cause an “artificially high” level of economic activity, the central banker said.

Trump tariffs push Asian trade partners to weigh investing in massive Alaska energy project

- President Donald Trump’s tariffs are pushing Japan, South Korea and Taiwan to consider investing in a massive natural gas project in Alaska.

- Alaska LNG would build an 800-mile pipeline, gas processing plant and LNG facility at a cost of more than $40 billion.

- Treasury Secretary Scott Bessent said the countries are considering financing the project and buying large amounts of gas.

AP

Zelenskyy says Russia is trying to create an ‘impression of a ceasefire’ as attacks continue

- Despite Putin’s declaration of an Easter ceasefire on Saturday, Zelenskyy said Ukrainian forces had recorded 59 instances of Russian shelling and five assaults by units across various areas along the front line, as well as “dozens” of drone strikes.

Reuters

Pope Francis makes brief Easter appearance, calls for Gaza ceasefire

- He is still recovering from pneumonia

Two dead in Oklahoma as severe weather hits US South and Midwest

- Tornado, storm, flood

Yahoo Finance

Tesla, Alphabet highlight earnings rush as tariff fallout drives markets: What to know this week

- Results from Alphabet (GOOGL, GOOG), Tesla (TSLA), Chipotle (CMG), Boeing (BA), and Verizon (VZ) are set to lead a week in which quarterly reports from more than 120 S&P 500 companies are expected for release.

- On Thursday, Trump struck an optimistic tone about negotiations with China, telling a reporter “we are going to make a very good deal with China.” Later in the day, the president again touted talks with the country, adding that he is reluctant to keep raising tariffs on China and may even want them to be lower to protect consumer spending.

Americans are expecting a tariff-fueled price surge. A new Fed survey says they’re right.

- “firms planned to pass along the expected tariff-induced changes in unit costs to their customers through price increases; the extent of this cost pass-through would vary under different tariff scenarios.”

Headlines and Quotations

CNBC

Hermès to hike U.S. prices for iconic bags and scarves in response to Trump tariffs

CNBC’s Inside India newsletter: Could India be a hedge against trade wars and tariffs?

- Analysts say India’s consumer-led economy, low exposure to international trade, and large number of domestic investors partly insulates it from the sell-off ravaging global markets in recent weeks.

- Lower oil prices, which typically precede a global economic growth slowdown, are also beneficial for the Indian economy.

Trump again calls for Fed to cut rates, says Powell’s ‘termination cannot come fast enough’

Netflix posts major earnings beat as revenue grows 13% in first quarter

- Netflix posted a major earnings beat on Thursday, as revenue grew 13% during the first quarter of 2025.

- In late January, the company increased its pricing across the board, raising its standard plan to $17.99 a month, its ad-supported plan to $7.99, and its premium plan to $24.99.

Google hit with second antitrust blow, adding to concerns about future of ads business

- Judge Brinkema ruled that Google unlawfully controls two of the three parts of the advertising technology market: the publisher ad server market and ad exchange market.

European Central Bank cuts interest rates, warns of ‘deteriorated’ growth outlook on trade tensions

- The European Central Bank made yet another 25-basis-point interest rate cut on Thursday

- The cut takes the ECB’s deposit facility rate, its key rate, to 2.25%. At its highs in mid-2023 it had been at 4%.

- The ECB on Thursday also said that “the disinflation process is well on track.”

- In particular, the judge cited the purchases of DoubleClick and Admeld and said the government failed to show those “acquisitions were anticompetitive.”

Reuters

Tesla speeds up odometers to avoid warranty repairs, US lawsuit claims

The plaintiff Nyree Hinton alleged that Tesla odometer readings reflect energy consumption, driver behavior and “predictive algorithms” rather than actual mileage driven. He said the odometer on the 2020 Model Y he bought in December 2022 with 36,772 miles on the clock ran at least 15% fast, based on his other vehicles and driving history, and for a while said he drove 72 miles a day when at most he drove 20.

Global Payments agrees $24.25 billion Worldpay deal as industry heavyweights shift focus

Global Payments has agreed to buy rival Worldpay from FIS and private equity firm GTCR for $24.25 billion in a three-way deal, sharpening its focus on merchant services in its race for big-business clients in a crowded payments market.

Investing.com

Stock market today: S&P 500 pares gains to close slightly higher amid tariff woes

Bloomberg

Moody’s Boosts Default Forecasts as Global Trade War Heats Up

- The credit-grading firm said it now sees the default rate for speculative-grade companies reaching 3.1% by the end of the year, compared with its prior expectation of 2.5%. If that forecast materializes, it would still amount to a decline in the default rate from the year prior, but Moody’s says it wouldn’t take a major negative shock for the rate to rise instead, possibly to as high as 6%.

Bill Ackman Makes Big Bet on Hertz Becoming Tariff Winner

- ill Ackman’s Pershing Square Capital Management has amassed a nearly 20% stake in rental car company Hertz Global Holdings Inc. in a bet that tariffs will push up car prices, the billionaire said in a social media post.

Yahoo Finance

WSJ

A Depleted Hamas Is So Low on Cash That It Can’t Pay Its Fighters

- “Even if they sit on large amounts of cash, their ability to distribute it would be very limited right now,” said Eyal Ofer, an open-source researcher on Gaza’s economy. Ofer said Hamas’s typical payment methods were to have a courier carry cash or to set up a disbursement point, either of which could create targets for Israeli troops. “Those two things would grab attention,” he said.

Trump Expresses Optimism on EU Trade Deal

Headlines and Quotations

WSJ

Powell Warns of ‘Challenging Scenario’ for Fed as Trade War Rages

- Powell also hinted that the central bank could give priority to its inflation goal over its labor-market mandate if the two were in conflict. The Fed would attempt to balance the two goals, “keeping in mind that, without price stability, we cannot achieve the long periods of strong labor market conditions that benefit all Americans,”

Stock Market Today: Nasdaq Slides 3% After U.S. Tightens Curbs on Nvidia’s China Exports

- The third-largest U.S. company by market value warned late Tuesday that it will take a $5.5 billion charge after the U.S. said it will need a license to export H20 processors to China and other countries.

- Earlier Wednesday, Commerce Department data suggested U.S. consumers front-loaded purchases during March. Retail sales surged 1.4% last month, as car buyers rushed to dealerships to get ahead of auto tariffs. The rise was even bigger than expected.

Nvidia Is Now the Biggest U.S.-China Bargaining Chip

- The company said this will lead it to take a current-quarter $5.5 billion charge related to inventory and purchase commitments for the chip.

Morgan Stanley analyst Joe Moore estimates the H20’s performance is about 75% below that of Nvidia’s H100 family. That was the company’s top-of-the-line AI chip two years ago.

Judge Finds Probable Cause to Hold Trump Administration in Criminal Contempt

- for willfully disregarding an order barring the removal of Venezuelan migrants from the country.

- U.S. District Judge James Boasberg in Washington said in an order that the government must act quickly to avoid possible prosecution, including potentially seeking custody of the migrants sent to a notorious prison in El Salvador.

El Salvador’s Bukele Plans to Double the Size of Giant Prison Holding U.S. Deportees

How Harvard Ended Up Leading the University Fight Against Trump

- The list included requirements that Harvard allow federal-government oversight of admissions, hiring and the ideology of students and staff.

U.K. Supreme Court Rules Trans Women Can’t Be Defined as Women

- Britain’s top court ruled only those born female can be considered women, a landmark judgment that excludes transgender women from the legal definition and paves the way for tighter limits on female-only spaces and services

The Tactics Elon Musk Uses to Manage His ‘Legion’ of Babies—and Their Mothers

Yahoo Finance

Bloomberg

Hertz Surges After Ackman’s Pershing Square Discloses Stake

- Hertz Global Holdings Inc. shares had their biggest gain ever after CNBC reported that Pershing Square Capital Management had amassed a position of almost 20% in the beleaguered car rental company.

Iran Says Ability to Enrich Uranium is ‘Non-Negotiable’ in Trump Nuclear Talks

- Iran said it won’t be drawn into negotiations with the US over its ability to enrich uranium

Headlines and Quotations

WSJ

Kristi Noem’s Made-for-TV Approach to Homeland Security

Trump Threatens to Revoke Harvard’s Tax-Exempt Status

- “Perhaps Harvard should lose its Tax Exempt Status and be Taxed as a Political Entity if it keeps pushing political, ideological, and terrorist inspired/supporting ‘Sickness?’”

- The government is asking for a comprehensive mask ban as well as changes to governance, leadership and admissions and an end to diversity, equity and inclusion, or DEI, programs.

The Little-Known Bureaucrats Tearing Through American Universities

- The lawyer grilled Armstrong over whether she had done enough to protect Jewish students against antisemitism.

Inside Mark Zuckerberg’s Failed Negotiations to End Antitrust Case

Meta offered $450M to settle an antitrust case, far less than the FTC’s $30B demand, centered on Instagram and WhatsApp acquisitions.

Big Banks Alarmed After Their Regulator Gets Hacked

- JPMorgan Chase, Bank of America and Bank of New York Mellon are seeking other ways to send sensitive information to the Office of the Comptroller of the Currency due to concerns around an email hack that is still under investigation

- The Office of the Comptroller of the Currency (OCC) charters, regulates, and supervises all national banks and federal savings associations as well as federal branches and agencies of foreign banks.

Blackstone Moves to Extend Its Reach Into Everyday Investors’ Portfolios

- The private-markets giant has formed an alliance with Vanguard and Wellington Management, with the goal of offering individuals access to multiasset portfolios, with private and public assets, that have otherwise only been available to institutional investors, the companies said.

- The partnership could give Blackstone a path to offer private-markets assets for target-date funds in 401(k)s, which many in the industry have long viewed as a holy grail.

CNBC

Nvidia says it will record $5.5 billion charge tied to H20 processors exported to China

- On April 9, the U.S. government told Nvidia it would require a license to export the chips to China and a handful of other countries, the company said in a filing.

- The H20 is an AI chip for China that was designed to comply with U.S. export restrictions. It generated an estimated $12 billion to $15 billion in 2024.

- Nvidia listed Huawei as a competitor in its annual filing.

Nvidia’s H20 chip is comparable to the H100 and H200 AI chips used in the U.S. and other countries, but it has slower interconnection speeds and bandwidth. It’s based a previous generation of AI architecture called Hopper introduced in 2022. Nvidia is now focusing on selling its current generation of AI chips, called Blackwell.

DeepSeek, the Chinese company whose competitive AI model R1 unveiled earlier this year upended markets, used H20 chips in its research.

U.S.′ inability to replace rare earths supply from China poses a threat to its defense, warns CSIS

- The new restrictions — which encompass the medium and heavy rare earth elements samarium, gadolinium, terbium, dysprosium, lutetium, scandium and yttrium — will require Chinese companies to secure special licenses to export the resources.

- As China effectively holds a monopoly over the supply of global heavy rare earths processing

- Trump has also been seeking a deal with Ukraine, which would give it access to its deposits of rare earth minerals. However, questions remain about the value and accessibility of such deposits.

Oil giant BP is seen as a prime takeover target. Is a blockbuster mega-merger in the cards?

- “I mean, within BP, a company that trades on three times EBITDA, there’s a division that can trade at 10 times EBITDA, right? Amazing. You can make the same point for a lot of the other Big Oils,” Della Vigna said.

OpenAI considering its own social network to compete with Elon Musk’s X

Apple airlifted iPhones worth a record $2 billion from India in March as Trump tariffs loomed

- Apple’s main India suppliers Foxconn

and Tata shipped nearly $2 billion worth of iPhones to the United States in March, an all-time high, as the U.S. company airlifted devices to bypass President Donald Trump’s impending tariffs, customs data shows.

Investing.com

Stock market today: S&P 500 ends lower after paring gains amid tariff uncertainty

- Bank of America (NYSE:BAC) stock rose more than 3% after the lender reported a rise in net interest income in the first quarter, as tariff-driven volatility spurring on record equities trading revenue at its global markets unit.

Yahoo Finance

Treasury Secretary Scott Bessent to Yahoo Finance: Not all tariff deals will be done in 90 days

Markets

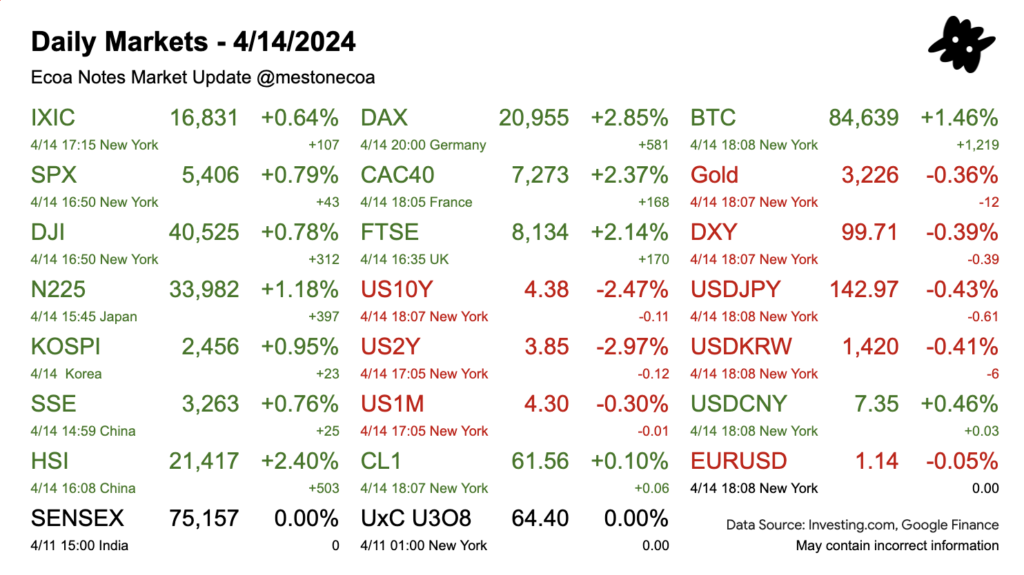

Although Trump says smartphone tariffs are here to stay, flexibility in policy retains optimism in the market. Initially staring out higher, US indices fell, although closing in the green. Global equities exhibited a similar level of optimism. Some recovery in the bond market brought yields down. $US10Y fell to 4.38% after soaring to 4.50%. $BTC reclaimed $85k, after touching $75k. What has not shown signs of recovery is $DXY. In early January the index recorded 109. Now it’s more than 10% down, at 99.71.

Headlines and Quotations

WSJ

Netflix Aims to Join the $1 Trillion Club

- “Netflix aims to achieve a $1 trillion market capitalization and double its revenue by 2030, ambitious goals that show its growing heft as the largest global streamer.”

Civilian Death Toll in Ukraine Climbs as Putin Resists Trump’s Peace Drive

- “Ukraine and European countries said the latest Russian missile strike, which killed 34 and left more than 100 injured in the city of Sumy on Sunday, showed Russian President Vladimir Putin wasn’t interested in a cease-fire.”

Wall Street’s Trading Revenue Powered by Tariff Uncertainty

- “Banks have been raking in fees as investors reposition their portfolios in anticipation of how Trump’s trade and other economic policies might rattle markets.”

Stocks Post Gains; Dow Rises More Than 300 Points

- “The president also said Monday afternoon that he is looking at some tariff pauses to help car companies. Shares of automakers like Ford and General Motors perked up on the news.”

CNBC

Sony raises PlayStation 5 prices in Europe citing ‘challenging’ economic environment

- The company said the U.K. recommended retail price is £429.99, a rise from the previous price of £389.99.

Unemployment fears hit worst levels since Covid as tariffs fuel inflation outlook, Fed survey shows

- “Consumer worries grew over inflation, unemployment and the stock market as the global trade war heated up in March, according to a Federal Reserve Bank of New York survey released Monday.”

Auto stocks rise as Trump says he wants to ‘help’ some car companies

- “I’m looking for something to help some of the car companies, where they’re switching to parts that were made in Canada, Mexico and other places, and they need a little bit of time because they’re going to make them here,”

Reuters

US stocks, Treasuries rebound but dollar dips amid tariff uncertainty

- “U.S. shares gained on Monday, while the dollar dipped, after the White House exempted smartphones and computers from U.S. tariffs but President Donald Trump said semiconductor levies were likely.”

Meta to use public posts, AI interactions to train models in EU

- “Meta Platforms said on Monday it would use interactions that users have with its AI, as well as public posts and comments shared by adults across its platforms, to train its artificial intelligence models in the European Union.”

US begins probes into pharmaceutical, chip imports, setting stage for tariffs

Investing.com

Newell Brands sees Moody’s rating downgrade with negative outlook

- “Despite Newell’s larger manufacturing footprint in the US compared to some of its competitors, which provides it with a competitive advantage, and declines in the cost of some inputs, such as oil, gas, and plastic, the company’s ability to implement pricing actions to improve margins will be limited. This is due to the discretionary nature of most of its products and weaker consumer demand.”

- “Newell is also expected to face higher borrowing costs as it seeks to refinance its significant upcoming debt maturities.”

Headlines and Quotations

WSJ

Tech Products Will Face Separate Levies, Trump Says

- “Trump stressed in a social-media post Sunday that “NOBODY is getting ‘off the hook'” on tariffs and that levies on tech products are simply moving to a different bucket.”

Tim Cook’s ‘Long Arc of Time’ Prepared Apple for the Trade War

- “Tim Cook and his adherence to the “long arc of time” won—again. The iPhone is exempt from the White House’s latest escalation of the trade war with China, the Trump administration quietly announced late Friday.”

- “The company rushed India-made iPhones to the U.S., and Cook no doubt lobbied Trump for an exemption from the China tariffs that had soared past 100% in recent days.”

Russian Missile Strike Kills at Least 34 in Ukrainian City

Wealthy Buyers Are Backing Out of Multimillion-Dollar Home Deals

- “buyers pull out of deals or tap the brakes amid global economic uncertainty. In the U.S., the richest 10% have 36.3% of their total assets in stocks and mutual funds, according to a new report from Realtor.com, which found real-estate comprised 18.7% of their total assets.”

Iran Has a Reason to Strike a Nuclear Deal: Its Economy Is in Trouble

- “Iran’s currency is among the weakest in the world. Inflation remains well above 30%. Young people are struggling to find work, and a frustrated middle class can no longer afford to buy imported goods.”

Will the Last Investor to Leave America Please Turn Out the Lights

- “Where they were in 2020, 2011, 2008, 1998, or for the older among them, 1987. Last week should join that list.”

- “Stocks, bonds and the dollar all sold off at once.”

Bloomberg

Trump Says He’s Looking at Tariffs on Chips, Electronics Supply Chain

- ‘President Donald Trump denies that there was a tariff “exception” for certain electronics announced Friday, saying in a post on Truth Social that these products are still subject to existing tariffs of 20% and that the administration is looking into tariffs on the whole supply chain for electronics.’

- “(Electronics are) exempt from the reciprocal tariffs, but they’re included in the semiconductor tariffs, which are coming in probably a month or two,”

CNBC

China urges Trump to correct mistakes and heed ‘rational voices’ on reciprocal tariffs

- “We urge the U.S. to heed the rational voices of the international community and domestic parties, take a big stride in correcting its mistakes, completely abolish the wrongful action of ‘reciprocal tariffs,’ and return to the correct path of resolving differences through equal dialogue based on mutual respect,”

Billionaire Ray Dalio: ‘I’m worried about something worse than a recession’

- Bridgewater founder Ray Dalio said on Sunday that he’s concerned that the global monetary system will break down.

- President Donald Trump’s tariff policies and growing U.S. debt are contributing to a new unilateral world order, Dalio said.

Reuters

Japan policymaker wants stronger yen, says Tokyo shouldn’t sell Treasuries

“Japan must strengthen the yen, such as by helping boost the country’s industrial competitiveness, as the currency’s weakness has pushed up households’ living costs, the ruling party’s policy chief said on Sunday.”

- “As a U.S. ally, the government shouldn’t think about intentionally using U.S. Treasury holdings,”

Markets

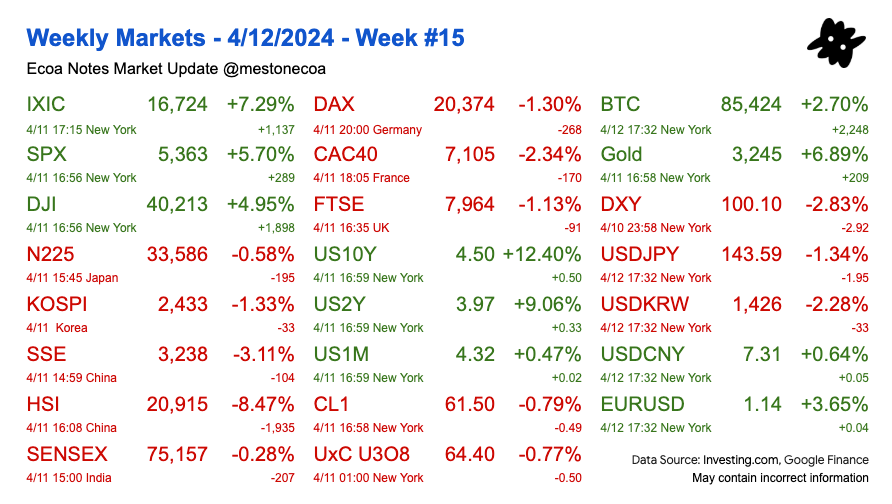

Significant swings were observed in the market. Since Liberation Day, $SPX recorded daily changes of -4.8%, -6.0%, -0.2%, -1.6%, +9.5%, -3.5%, and +1.8%. On a weekly basis, $SPX fell -9.1% last week and rose +7.3% this week, resulting in a -8.6% YTD decline. Treasury yields saw major swings as well. #US10Y ended at 400bps last week. Following a frenzy of long-dated bond sell-offs this week, however, yields closed at 450bps, recording a 12.4% rise. The increased refinancing cost of government debt is considered a key factor behind the 90-day reprieve on Liberation Day levies. $BTC rose above 80k again on the news. $Gold also resumed its ascent, reaching $3,245 per ounce. The dollar continued its decline, with $DXY closing barely above 100 after falling -2.8% for the week. #Oil, after dipping below $60/barrel, barely retained the $60 mark by the end of the week. Hong Kong stocks suffered significantly, with $HSI -8.5% and $SSE -3.1% as the US-China trade battle intensified.

Headlines and Quotations

Bloomberg

Apple, Nvidia Score Relief From US Tariffs With Exemptions

- “Trump’s administration exempted smartphones, computers and other electronics from its so-called reciprocal tariffs.”

Bessent Has a ‘Grand Encirclement’ Plan for China

- “The nations Bessent said he’s looking to – Japan, South Korea, Vietnam and India – happen to be neighbors of China.

- “The Obama administration’s big trade idea was using the Trans-Pacific Partnership to assemble a coalition of Pacific Rim nations that would increasingly be tied to the US and not drift into China’s orbit. Trump abandoned the TPP shortly after first taking office in January 2017.”

Oaktree, TCW and Sona Spot Opportunity in Market Turmoil

- “Average spreads in the US HY bond market are about 419bps – lingering around the highest since late 2023”

- “The market is running from credits with tariff-related risk,” he said. “There are going to be survivors in that cohort and we want to identify those and invest in them at improved prices.”

UK MPs Pass Emergency Bill to Rescue Troubled British Steel

By Plan or Luck, Trump Landed His First Blow on China

- US needs to limit China’s access to Western markets and deepen integration with advanced democracies.

CNBC

Trump tariffs on China will soon bring ‘irreversible’ damage to many American businesses

- “For most businesses in the U.S., orders from China are being canceled and Chinese freight being shipped could be abandoned.”

- “We had the same across Southeast Asia, but after the 90-day reprieve those bookings have restarted,”

As U.S. and Iran look to begin nuclear talks amid fresh sanctions, can there be a deal?

How China used Vietnam to evade higher U.S. tariffs

- “A portion of Vietnam’s rising exports to the U.S. may be Chinese products that were rerouted to evade higher tariff rates.”

- “Think 24-hour markets and a trading settlement process that can be compacted down into seconds from a process that today can still take days, with billions of dollars reinvested immediately back into the economy.”

Trump’s ongoing 25% auto tariffs expected to cut sales by millions, cost $100 billion

Investing.com

UK finance minister eyes closer EU ties, warns ’profound’ impact of tariffs

- “she wants to achieve “an ambitious new relationship” with the European Union while still negotiating a trade deal with the United States.”

07:56-08:38

Headlines and Quotations

WSJ

Stocks Renew Selloff as China Trade War Sinks In

- Tariffs against China add up to 145%, not 125%

- Lower than expected CPI. Short term yields all.

- Goldman Sachs China growth outlook 4% -> 3.5%

Why Trump Blinked on Tariffs Just Hours After They Went Into Effect

- Countries lining up to make deals & lots of calls from American businessmen

Trump’s Trade Math Ignores a Major Export: American Services

- “While the U.S. buys more goods from abroad than it sells, the opposite is true for services, which include everything from streaming subscriptions to financial advice. Trump left these service exports out of his tariff math, but they are being pulled into his trade wars.”

How America’s Wealthy Are Positioning Themselves During the Market Turmoil

- “Financial advisers who serve wealthy clients say they have been bombarded by investor calls over the past week”

- such as adding some exposure to Europe, Japan or foreign currencies to further diversify their portfolios.

Trump’s Tariff Man Peter Navarro Is Down but Not Out

The Dollar and the Bond Market’s Ominous Message for Trump

- “Less demand for dollar assets makes it harder to finance the U.S.’s massive borrowing.”

- ” As of last June, foreigners held $7 trillion of Treasury bonds (half by official investors such as central banks)”

- “So the U.S. needs foreigners to keep rolling over the bonds they hold, and buying new ones.”

Trump Promised a Golden Age for Oil and Gas, but Tariffs Undermine His Pledge

- “Although the president’s duty increases exempt energy flows, fears of a global recession have damped crude prices.”

Trump Wants to Dominate Shipping. America Doesn’t Have Enough Sailors.

Trump Plans to Withhold All Federal Funding From Sanctuary Cities

Inflation Eased in March, but Tariffs Threaten to Stoke Price Pressures

CNBC

Trump trade advisor says stock market plunge ‘No big deal’: Live updates

Trump’s triple-digit tariff essentially cuts off most trade with China, says economist

10-year Treasury yield pulls back after light March inflation report

06:57 – 07:29

Headlines and Quotations

Bloomberg

Goldman Sees Slower China Growth as 125% US Tariff Hits

- Trump announces 90-day pause on higher tariffs except for China

- China leaders discuss stimulus as US sets 125% tariff

Traders Reveling in Rally Wonder Just How Far It Can Go

- America’s third-largest trading partner that sent more than $500 billion worth of goods last year.

- Trump also left a 10% levy against the rest of the world.

Yuan Falls Versus Everything as China’s Tariff Relief Valve

- China is letting the yuan weaken against almost all major currencies

- The onshore yuan dropped to levels last seen during the global financial crisis against the dollar on Thursday.

US Crude Flows to China Trickle to Near Zero After Tariff Blitz

- After climbing in recent years, oil shipments from the US to China have been on the decline for much of 2025

- Some of that crude would instead be going to other buyers in Asia. In recent days, Indian refiners have purchased cargoes to take advantage of lower prices.

- China will likely fill the gap with supply from Oman, UAE, Iran or Russia

US Tariffs Are Still at Historic High Even After Trump’s Pause

- The average US tariff rate is still rising to 24%, up almost 22%p since Trump started his second term.

Taiwan Aims to Triple US Share of LNG Imports to Avoid Tariffs

- Asian governments from South Korea to Indonesia are rushing to sign up for LNG purchases from the US, hoping to reduce trade surpluses.

Goldman Warns Oil Crash Could Push Saudi Arabia’s Budget Deficit to $67 Billion

TSMC Sales Beat Estimates as AI Demand Soars Ahead of US Tariffs

- 25Q1 rose a larger than anticipated 42%, reflecting strengthening demand for AI servers and smartphones before US tariffs kicked in.

A $20 Billion Gas Plant Exposes Australia’s Energy Conundrum

- Australia’s top exports:

- Coal: A$91b

- Gas: A$68b

- Education-related Travel Services: A$51b

- Gold: $33b

- Personal Travel: A$22b

CNBC

China consumer prices decline for a second straight month; producer deflation deepens

- Producer prices fell for the 29th straight month, dropping 2.5% in March from a year earlier and marking the largest contraction since November 2024.

- Consumer price index slid 0.1% year on year in March, remaining in deflationary territory after having contracted 0.7% in February, according to data released by the National Statistics Bureau Thursday.

Live: S&P 500 futures fall after historic rally on Trump’s tariff walkback

Futures tied to the S&P 500 were 0.66% fell, while Nasdaq-100 futures traded up 1.2%. Dow Jones Industrial Average futures lost 108 points, or about 0.3%.

The moves come after a historic surge on the Street, where the S&P 500 soared more than 9% during Wednesday’s session to see its third-largest gain in a single daysince World War II.

Live: Trump tariffs: ‘Do not retaliate and you will be rewarded,’ White House says

- White House advisors claimed the flip flop was always the strategy, suggesting that the past week of massive tariffs that triggered huge market losses was all for show.

- Beijing has announced a reciprocal 84% tariff rate on U.S. goods, effective April 10.

Dot-com bust, 1987 crash had massive relief rallies similar to Wednesday’s pop

- During the financial crisis in October 2008, the Nasdaq enjoyed two of its best five days ever. The other two came as the tech bubble was bursting. The index’s sixth-best day since its beginning in 1971 came on March 13, 2020, as the Covid pandemic was hitting the U.S.

- Call it a dead-cat bounce, a relief rally or short covering. It’s a familiar reaction during the worst of times for Wall Street.

- The big difference between the current market tumult and the downturns in 1987, 2000-2001, 2008 and 2020 is that many investors say this one was easily avoidable and, potentially, can be reversed based on what the president decides to do.

15:25-15:54

Headlines and Quotations

CNBC

Trump trade fight: Customs starts collecting new tariffs on imports from 86 countries at midnight

Elon Musk ratchets up attacks on Navarro as Tesla shares slump for fourth day

- Musk called Navarro “dumber than a sack of bricks,” before later apologizing to bricks. Musk also called Navarro “dangerously dumb.”

Tech analyst responds to Trump wanting Apple to make iPhones in U.S.: ‘I don’t think that’s a thing’

- Wedbush analyst Dan Ives said an iPhone would cost $3,500 if produced in the country.

- Additionally, the process of Apple moving its supply chain to the U.S. would take years, Martin said. Most supply chain experts say making iPhones completely in the U.S. is impossible.

Investing.com

Stock Market Today: S&P 500 ends below 5,000 in ugly reversal on trade war angst

- amid rising worries about global trade war as the Trump administration prepares to hike levies on China at midnight.

- President Trump later Monday reaffirmed his administration’s commitment to implementing reciprocal tariffs, downplaying any leeway for negotiations.

Is China dumping US treasuries?

- Today, the U.S. 5-year treasury rose 2% to 3.918%, the 10-year rose 3.2% to 4.291%, and the 30-year rose 3.6% to 4.762%.

- China held $761 billion in U.S. treasuries as of the end of January, the second largest foreign holder behind Japan at $1.08 trillion.

Reuters

Wood Mackenzie cuts 5-year US wind energy outlook 40% on Trump policies

Trump says US taking in $2 billion a day from tariffs

- For the entire month of February, the latest full month available, the Treasury netted about $7.25 billion in customs duties. The monthly budget statement for March will be released on Thursday, which will show the latest monthly figures.

Yahoo Finance

- “At the slightest whiff of good news, people come roaring back in because that FOMO [fear of missing out] never goes away,”

Signs of Wall Street stress pile up amid Trump tariff turmoil

- IPOs and mergers were put on the shelf. Leverage loan deals were shoved to the sidelines. Bond sales were paused.

- One concerning development is that there were no new offerings in the investment-grade and high-yield bond markets for three days, according to Reuters, as credit spreads widened due to concerns about the rising odds of a recession.

WSJ

Supreme Court Halts Order Requiring Trump Administration to Reinstate Federal Workers

- The Supreme Court lifted a lower-court order that directed the Trump administration to reinstate about 16,000 federal employees it fired, handing the White House the third victory in a row as it seeks the justices’ emergency action to stop district judges from slowing its policies.

Justice Department Scales Back Crypto Enforcement

- The department will no longer bring charges against exchanges, dealers, mixing services and wallet providers “for the acts of their end users,” according to a memorandum issued late Monday by Deputy Attorney General Todd Blanche.

Headlines and Quotations

Yahoo Finance

Trump’s economic team faces flood of tariff critiques — even from top White House allies

- more than 50 countries have reached out to begin negotiations

- Musk posted that “a PhD in Econ from Harvard is a bad thing”

- if China does not withdraw its 34% increase above their already long term trading abuses by tomorrow, April 8th, 2025, the United States will impose ADDITIONAL Tariffs on China of 50%, effective April 9th.

Bloomberg

The 7-Minute $2.5 Trillion Stock Rally Confounds Wary Investors

- The rumors only lasted about seven minutes.

- “There’s no question that if Trump woke up tomorrow and said, ‘you know what? I’m not doing this’ the markets would just move back to a new high,” said Ross Gerber

China Vows ‘Fight to the End’ on Tariffs as It Props Up Markets

Reuters

Chinese LNG buyers resell US cargoes as tariffs bite

- China, the world’s largest buyer of liquefied natural gas, imported no U.S. LNG during March, data from Kpler and LSEG show.

Hong Kong leader says city will sign more free trade pacts amid ‘ruthless’ US tariffs

Markets

Tariffs soaring into the double digits, introduced last Wednesday—now dubbed Liberation Day—have sent investors fleeing. Analysts who once projected yet another record high for U.S. indices are now reversing their outlooks as these tariffs pose incalculable uncertainty into nations and businesses alike. A weaker dollar, which until recently made U.S. investments more enticing, could intensify this exodus. Two consecutive sessions with losses exceeding 5% in major indices have driven Treasury yields sharply lower as investors seek safe havens, a development that could ease the refinancing of U.S. debt. Oil prices have also tumbled, dropping more than 10% this week. Meanwhile, $BTC has begun its descent, slipping below the $80k mark.

Headlines and Quotations

CNBC

British carmaker Jaguar Land Rover pauses U.S. shipments over Trump tariffs

- The U.S. president has implemented a 25% tariff on all foreign cars imported into the country, a move that came into effect on Thursday. The White House also said it intends to place tariffs on some auto parts no later than May 3.

EU seeks unity in first strike back at Trump tariffs

- The 27-nation bloc faces 25% import tariffs on cars and steel and aluminium, and “reciprocal” tariffs of 20% from Wednesday for almost all other goods.

TikTok reportedly stays on App Store after assurance from Attorney General Pam Bondi

- President Donald Trump extended the divestiture deadline for U.S. operations for at least 75 days.

Bitcoin drops Sunday evening as cryptocurrencies join global market rout

- The price of bitcoin was last lower by 4% at $78,835.07

Bloomberg

Tesla Bull Slashes Stock Price Target 43%, Citing Musk and Trump

- Ives reduced his Tesla share-price target to $315 from $550, which had been the second-highest among the 72 analysts tracked by Bloomberg.

- Ives’ biggest concern is the potential for Tesla to get caught up in backlash against the US president’s tariff policies in China, where Tesla generated more than a fifth of its revenue last year. President Xi Jinping’s government plans to impose a 34% tariff on all imports from the US starting April 10, matching the level of Trump’s so-called reciprocal tariffs on Chinese products.

Bessent Defiant on Tariffs as He Rejects a US Recession

Treasuries Star as a Haven Even as Trump Fans Stagflation Fears

- After a rally in US government debt that sent the two-year yield to touch the lowest since 2022, traders are positioning for more gains and pricing in a greater chance the Federal Reserve moves most aggressively to cut interest rates to keep the economy from stalling.

Yahoo Finance

Forget 60/40. BlackRock’s Larry Fink wants investors to embrace 50/30/20.

- “The future standard portfolio may look more like 50/30/20 — stocks, bonds, and private assets like real estate, infrastructure, and private credit,” Fink wrote in his annual letter to clients this week.

Reuters

Hamas fires rockets at Israeli cities, Israel issues evacuation orders in Gaza

- Palestinian militant group Hamas said it fired a barrage of rockets at cities in Israel’s south on Sunday in response to Israeli “massacres” of civilians in Gaza.

Russian troops push into Ukraine’s Sumy region

- Ukrainian officials later denied the report, saying Russian forces were not in control of Basivka.

Le Pen evokes spirit of Martin Luther King Jr. as supporters rally in Paris

- A Paris court convicted Le Pen and two dozen National Rally (RN) party members of embezzling EU funds last week and imposed a sentence that will prevent her from standing in France’s 2027 presidential election unless she can get the ruling overturned within 18 months.

WSJ

How Investing Will Change if the Dollar No Longer Rules the World

- If you’ve been investing your savings for the past 15 years, there is a situation you’ve hardly ever encountered: the U.S. dollar getting structurally weaker. Given the fallout from President Trump’s “Liberation Day,” you may need to get used to it.

- Two forces helped drive this. One was the fracking boom, which made the U.S. largely energy self-sufficient, cutting corporate costs and turning the dollar into a kind of “petrocurrency.”

- The other factor was that U.S. consumer spending was unrelenting, even at times when gas-pump prices increased. For years, it has been powered by government deficit spending, a tech sector exporting services globally at scale, and the wealth effects from a booming stock market.

In Vietnam’s Streets and Factories, Boom Built on U.S. Trade Suddenly Looks Fragile

- For Ha Pham, who runs a network of garment factories employing 500 Vietnamese workers, America has been good for business.

- So when Trump ordered a 46% tariff on Vietnamese goods, to go into effect on Wednesday, it sent her on a crash mission to find new customers in Europe and elsewhere.

- The U.S. trade deficit with Vietnam—the basis for Trump’s tariff rate—is third only to China and Mexico.

Trump Promised to Lower Energy Prices—but It Wasn’t Supposed to Be Like This

- Instead, frackers—and everyone else—are caught in a trade war that investors fear will clobber the global economy and sink demand for crude oil. Over two trading sessions, benchmark U.S. oil prices fell almost 14% to $61.99 a barrel, their lowest level since April 2021. That’s a price that shale drillers say would eventually hinder their investment plans.

Headlines and Quotations

WSJ

In Matter of Days, Outlook Shifts From Solid Growth to Recession Risk

- The duties unveiled by Trump on April 2 will raise the average effective U.S. tariff rate from 2.5% in 2024 to around 22.5%, according to the left-of-center Yale Budget Lab.

- Trump said on social media last week that his policies never change, suggesting negotiations were off the table. But on Friday, Trump claimed Vietnam had offered to eliminate its tariffs in return for a deal. Markets interpreted that as a willingness to negotiate, sending up the shares of Nike which sources from Vietnam.

China Wanted to Negotiate With Trump. Now It’s Arming for Another Trade War.

Nations Strategize Before Week of Rising Trump Tariffs

Americans Are Sitting on a Cash Pile as Stocks Reel

CNBC

How Trump’s tariffs rollout turned into stock market mayhem

- The plan: Slap 10% tariffs on every U.S. trading partner starting Saturday, with individualized rates for 60 other countries that would begin in a week. Virtually overnight, the effective U.S. tariff rate was set to spring from 2.5% to well past 20%.

- China retaliated with 34% tariffs on all goods, European Union leaders also are considering countermeasures, and the suddenly antagonistic relationship with Canada and Mexico will have to be smoothed over during United States-Mexico-Canada Agreement talks in coming months.

- Investors responded by selling everything except bonds.

China to impose 34% retaliatory tariff on all goods imported from the U.S.

- The ministry criticized Washington’s decision to impose 34% of additional reciprocal levies on China — bringing total U.S. tariffs against the country to 54% — as “inconsistent with international trade rules.”

Automakers seek ‘opportunity in the chaos’ of Trump’s tariffs

- Ford and Stellantis are offering employee-pricing programs, while Hyundai Motor said it would not raise prices for at least two months to ease consumer concerns.

Trump’s 25% auto tariffs are in effect. What investors need to know

- The 25% tariffs are on any vehicle not assembled in the U.S., which S&P Global Mobility reports accounted for 46% of the roughly 16 million vehicles sold domestically last year.

- some auto parts such as engines and transmissions, but those are set to take effect no later than May 3.

- Excluding potential tariffs on parts, U.S. electric vehicle leader Tesla as well as EV startups Rivian Automotive and Lucid Group are far better positioned. All of their vehicles sold in the U.S. have final assembly in the country.

How did the U.S. arrive at its tariff figures?

- Many, including journalist and author James Surowiecki, said the U.S. appeared to have divided the trade deficit by imports from a given country to arrive at tariff rates for individual countries.

China says ‘market has spoken’ after Trump tariffs spark global stocks rout

Yahoo Finance

Trump tariffs live updates: 10% tariff begins, Musk calls for US-Europe ‘zero-tariff situation’

- Elon Musk, appearing at an event on Saturday, said that “Europe and the United States should move, ideally, in my view, to a zero-tariff situation.”

The many ways Trump world is explaining the market’s tariff tantrum

- Trump’s message is that tariffs are best understood as the force that will instead steady America’s economic ship. That’s why markets eventually “are going to boom,”

- Bessent repeatedly focused on DeepSeek, a Chinese artificial intelligence company, to make the case, as he put it on Fox, that “a lot of what we have seen has been just an idiosyncratic tech sell-off.”

Stock rout and dealmaking freeze raise stakes for start of Wall Street’s earnings season

- Amid the turmoil of this past week, StubHub and Klarna (KLAR.PVT) decided to postpone their IPO roadshows, while another fintech company called Chime (CHIM.PVT) delayed its plans to go public, according to the Wall Street Journal.

- Executives at JPMorgan, Goldman, and Bank of America, as a result, are already considering revising down revenue for their M&A advisory businesses, according to Bloomberg.

Bloomberg

Wall Street Gets Rude Shock as Bessent Plays Second Fiddle on Tariffs

- The tariffs were largely shaped by a small group within Trump’s inner circle, with critical decisions about the duties’ structure going down to the wire before the president’s announcement.

Tariffs Stoke Fears That Hung Debt Will Return

- Wall Street lenders typically sell credit they’ve committed for an acquisition before it closes, but face the prospect of being left with so-called “hung” debt if they can’t move underwritten loans off their balance sheets by that time.

- New issuance of junk debt, too, has ground to a halt in the US. The past six trading sessions saw just one new high-yield bond and no leveraged loan launches.

AP

Tariffs will make sneakers, jeans and almost everything Americans wear cost more, trade groups warn

- About 97% of the clothes and shoes purchased in the U.S. are imported, predominantly from Asia, the American Apparel & Footwear Association said, citing its most recent data. Walmart, Gap Inc., Lululemon and Nike are a few of the companies that have a majority of their clothing made in Asian countries.

Markets

Notable rebound in tech drives market upward as tariff concerns ease. Trump came up with various statements regarding tariffs – again-on Venezuelan oil, Chinese ships, auto, pharma. However, also mentioned a lot of countries would be eligible for a step-down in tariffs. $SPX rose 1.8%. Meanwhile, India’s $SENSEX continues to pick up, rising 6.5% MTD. $BTC tests $90k as Trump’s cabinet hosts a round table to discuss concrete measures around the de-regulation of the crypto market.

Headlines

• Dow jumps nearly 600 points on Monday as investors hope Trump softens tariff stance: Live updates

Trump said on Monday a lot of companies could get tariff breaks. $TSLA climbed 12%

• Trump says countries that purchase oil from Venezuela will pay 25% tariff on any trade with U.S.

“that’s on top of existing tariffs”

• Investors’ optimism is growing around the UK economy as U.S.-EU trade disputes mount

• China’s open-source embrace upends conventional wisdom around artificial intelligence

• Tesla brand damage is ’overdone’, Piper Sandler says

Reiterates buy-stance as they deem supply chain shock as the driver behind lagging sales.

• Trump says he will soon announce tariffs on autos, aluminum, pharmaceuticals

• US SEC holds crypto task force roundtable as Trump plans regulatory revamp

• Alibaba-affiliate Ant combines Chinese and U.S. chips to slash AI development costs

• South Korea’s Hyundai announces $21 billion U.S. investment

Includes $5.8b steel plant in Louisiana

• FBI launches Tesla threats task force: ‘This is domestic terrorism’

• Heathrow Airport had enough power to avoid shutdown after fire, Britain’s National Grid says